More than 2.5 lakh Indian students went abroad for higher studies in 2020. Between 2016 and 2022, the number of Indian students studying overseas has risen by 20 per cent. Reports estimate that by 2024, close to 20 lakh Indian students will be enrolled in institutions outside India.

And yet, for every Indian student that gets to pack their bags and explore a new country each year, so many more are left with their abroad dreams delayed or denied. One of the main reasons for that is the lack of financial resources. For most students hailing from middle-class backgrounds or lower rungs of the economic ladder, an overseas education cannot be financed without an education loan, something that is far from easy to obtain in India.

Having spotted this chink in India’s lending armour, Jainesh Sinha co-founded GyanDhan in 2016 for end-to-end educational loan assistance and facilitation in an attempt to make overseas education more accessible for Indians. Since then, GyanDhan has disbursed over Rs 3,000 crore in study abroad loans to more than 10,000 students in India.

My Kolkata caught up with the Gurgaon-based Jainesh to understand his motivation behind setting up GyanDhan as its COO, how students benefit from it, his own journey to academic excellence at IIT and more.

Edited excerpts from the conversation follow.

Going to IIT would provide me with a good job and a stable income to help my parents

Ever since his school days, Jainesh aspired to study at an IIT Courtesy: Jainesh Sinha

My Kolkata: Tell us briefly about your background and how you came to decide that you wanted to be an IITian?

Jainesh Sinha: I was born in Bengaluru. My father was in the Air Force, so for the first few years of my life we hopped around quite a few cities, till we came to my hometown of Patna when I was five. A while after relocating to Patna, where I completed the entirety of my schooling, we hit a rough patch in terms of our financial situation. Pensions were quite low back then, and my father had to do a few odd jobs after retirement. I had what you’d call a typical lower middle-class upbringing based on austerity.

In school, I was fortunate to always be at the top of my class. This led to my friends suggesting that I should try my luck at cracking IIT. I realised that going to IIT would provide me with a good job and a stable income to help support my parents. I needed coaching to stay ahead of the curve for the IIT entrance exams, but it wasn’t something I could afford. So, my friends came to my aid, sharing their study material with me. Later on, during the last quarter of my preparation, I also received assistance from Super 30 (an educational programme in Patna founded by Anand Kumar, a mathematics teacher, that selects 30 candidates from economically underprivileged sections of India each year and trains them for the Joint Entrance Examination).

The innovative methods of Anand sir, the homely atmosphere, were accurately depicted in 'Super 30'

Jainesh was one of countless students to have benefited under the guidance of Anand Kumar at 'Super 30' TT archives

How was your experience with Super 30? How much of a difference did that make in your IIT JEE journey?

It was a great experience. My time at Super 30 helped me in rounding off a lot of concepts, in making them clearer and more robust. Because we stayed in a gurukul-esque setting, there was a lot of cross-pollination of ideas, and I actually learnt more from my friends than I did from the teachers. The practice tests we undertook also proved really useful, especially in relation to my performance in maths, which had been a weakness.

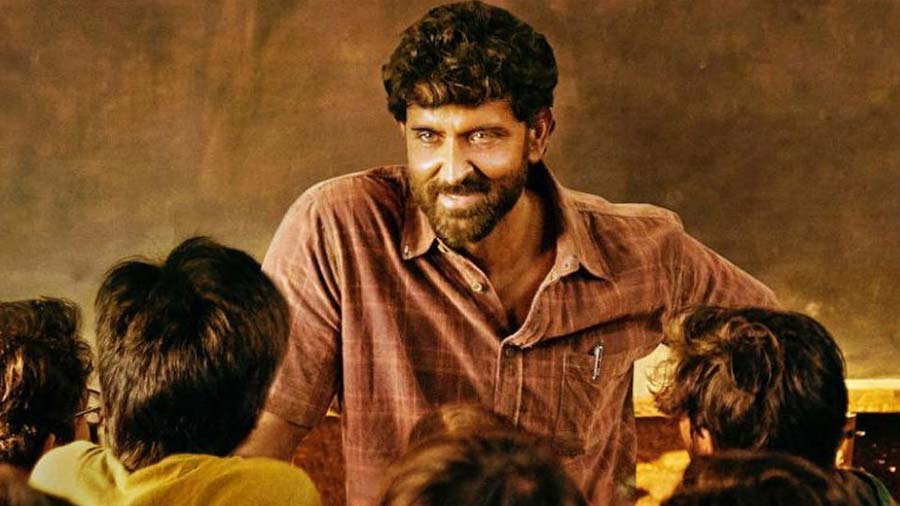

Hirthik Roshan essaying the role of Anand Kumar in 'Super 30', the film on the life and work of Kumar

What did you make of the cinematic representation of Super 30 starring Hrithik Roshan? Do you feel the film did justice to the story?

Obviously, the movie tries to fantasise and embellish the reality to some extent. For instance, there was no attack on Anand Kumar in real life, but I understand why a film has to do it commercially. Having said that, the innovative methods of Anand sir, the homely atmosphere that was created at Super 30, were all accurately depicted.

Education wasn’t the be-all and end-all at IIT; I also learnt a lot about management and leadership from what I did outside the classroom

IIT Delhi instilled several important life skills in him, believes Jainesh TT archives

What were your most important takeaways in terms of life skills from your time at IIT Delhi?

While at IIT, I realised that college isn’t simply a vidya ka mandir, as one of my mentors put it. Education wasn’t the be-all and end-all at IIT. Throughout my time there, I was quite active in extracurricular activities, particularly cultural ones. While I enjoyed my academic learning at IIT, especially the approach that the professors had to teaching, I also learnt a lot about discipline, management and leadership from what I did outside the classroom. During my first year, I was heavily involved in debates and street plays, and in my second year, I gravitated to the robotics club, where we managed to win quite a few competitions and even represented India internationally in Vietnam.

My time at IIT taught me a lot of skills that held me in good stead at GyanDhan, from focusing on meeting targets to my people and communication skills to the management of resources.

After graduating from IIT Delhi, you spent two years at ZS Associates in Delhi before moving to Capital One in Bengaluru, and eventually, in Washington D.C. How did your experience in the corporate sector prepare you for your current role at GyanDhan?

The most important thing I learnt, especially at Capital One, was to make decisions based on empirical evidence through data and analytics instead of relying on gut feeling. Then there was the development of people management skills, which I had got a taste of in college, but doing it in a professional setup had its own challenges that proved useful later on in running GyanDhan.

I understood that there was an immediate need for increasing access to education loans

Ankit Mehra (left) and Jainesh were colleagues at Capital One before proceeding to found GyanDhan together Courtesy: Jainesh Sinha

GyanDhan was born out of a conversation with Ankit Mehra (then Jainesh’s colleague at Capital One and presently the CEO of GyanDhan). What did the two of you talk about and what was your Eureka moment?

Ankit and I were in the same team at Capital One and we had a good relationship, chatting frequently to each other. After five years at Capital One, I wanted to do something different. As someone who got to understand lending in detail at Capital One, I identified the problem with accessing education loans in India. I had myself endured difficulties with education loans during my formative years. So, I arrived at the idea of doing something along the lines of increasing access to education loans, and coincidentally, Ankit was also thinking of doing something similar. The Eureka moment was that we had thought of pretty much the same idea independently!

I decided to take a sabbatical after speaking to my bosses at Capital One. I came back to India and spoke to a lot of experts in the field, attended a few conferences and tried to collect as much information as I could about the viability of the venture. Eventually, I understood that there was an immediate need for the idea and then everything fell into place from there.

We negotiate with the lender to get the best deal possible for the student

GyanDhan’s mission is to revolutionise education financing in India by equalising and expanding access to education. How exactly do you go about achieving its mission?

GyanDhan is about making education loans for overseas courses more accessible for students in India. So, if you are looking for an education loan to study abroad, chances are that your friends or your admission consultant will refer you to GyanDhan. Our value proposition is that we facilitate education loans for you through our networks and associations in the marketplace. We have a lending licence ourselves, but that’s a small portion of the lending that we facilitate currently. Most of the loans that we secure for the students are through our partners at the State Bank of India, ICICI Bank, Bank of Baroda, HDFC Credila, among others.

Once we receive the application of a student for an education loan, we determine the best possible lender for them. Then we explain our choice so that we and the student are on the same page. After that, it’s about the formal submission of documents, which mostly happens through scanning and uploading on our website, except for the lenders that prefer physical submissions. Once the documents are in, it’s our headache to get a response on the application.

How we add value is by ensuring the lenders don’t waver from their commitments or their credit policies. We keep the lenders honest. Then, we negotiate the best terms with the lender for the student to ensure that the student gets the best deal possible. We don’t charge anything from the student for the entire process. The student also doesn’t pay anything more to the lender than they would have had they negotiated privately. In fact, in many cases the student ends up paying far less to the lender since we negotiate the best deal on their behalf.

How do you generate your revenue if you do not charge anything from the student?

Our revenue is generated through the commission that lenders pay to us. They are incentivised to do so because for most of these lenders education loans aren’t a priority, so a lot of their soft leads – those involving walk-in customers enquiring about education loans – don’t mature. For every 100 home loans a bank gives, they probably give out just one education loan. However, when these lenders associate with us, we not only send them applications in bulk, but also make sure that they are serious applications that have a high chance of maturity. Additionally, the whole process of looking at the student’s qualifications and their academic background is something banks don’t have to do when collaborating with us because we already do that. All this means we’re able to command a good enough payment from the lender without compromising anything on part of the student.

Seventy per cent of the loans that we facilitate are without collateral

One of the major issues with education loans for overseas colleges is the need to provide collateral (an asset pledged as security for repayment of a loan), which a lot of students are not in a position to do. Do most of the loans you facilitate also require collateral?

As of last year, roughly 70 per cent of the loans that we facilitate are without collateral of any kind. We feel this number will continue to rise since the dependence on collateral is beginning to reduce in the education loan ecosystem. There are some courses that are still considered to be risky, in that it’s difficult to estimate a student’s earning potential after the completion of that course. But for most courses and programmes, especially those in STEM, law and public policy, and even some in the humanities, we’re able to provide loans without collateral, sometimes to the tune of Rs 75 to 80 lakh.

US and Canada are the top two destinations for Indian students, closely followed by the UK

North Carolina State University is fast emerging as a popular destination for Indian students abroad, explains Jainesh TT archives

Which are the most popular countries for Indian students to study abroad now? Additionally, what are the colleges or universities outside the traditional powerhouses that are gaining traction in recent times?

In terms of destinations, the US and Canada are the top two, because of high income potential and extremely liberal immigration policies, respectively. They are closely followed by the UK. Due to Covid-19, we’ve seen a sharp fall in the traffic to Australia but that should bounce back soon. In Europe, Ireland seems appealing to a fair few students, as well as countries where education is subsidised, such as Germany.

For colleges, it’s interesting to see that the traditional Ivy League colleges in the US don’t command a lot of volume from India, mostly because their tech programmes – with some exceptions like Stanford University – aren’t highly ranked. Then there’s the factor that they’re extremely selective and expensive, too, across courses. Some of the universities that have come up recently but aren’t historically well-known in India are the University of Texas at Dallas and North Carolina State University.

Jainesh with Evelyn Chilomo, CEO, Lupiya Circle at the 2017 Global Entrepreneurship Summit Courtesy: Jainesh Sinha

Last year, Rs 650 crore loan amount was provided to a little more than 2,000 students

Give us an idea of the scale at which GyanDhan operates. How many applications do you get in a year? And what is the conversion rate like in terms of applying for loans and actually getting them?

Last year, we closed at Rs 650 crore in terms of total loan amount provided, which comes down to a little more than 2,000 students who had their loans successfully processed. This year we’re on track to triple that volume and we are getting around 200 to 250 loan applications every day. Of all the applications we receive, around 30 per cent don’t fit any loan criterion and get declined. In such cases, we reach out to students to tell them what they can do differently so as to have a more feasible application the next time around. At the second stage of the process, which involves consultation, some more rejections come up because students may or may not fit certain specific criteria. That’s when we advise students to seek a co-applicant for the loan or get a collateral or see if they can get into a better college.

The highest applicants are from Hyderabad, followed by Pune, then Chennai; Kolkata is in seventh position

Hyderabad and Pune lead the way in terms of demand for overseas education loans in India TT archives

Which cities bring in the most applicants around India? What are the levels of interest from Kolkata?

The most demand for loans comes from the metro cities. The highest is from Hyderabad, followed by Pune, with the large number of engineering colleges in both cities being a major reason. We also get a lot of applicants from Chennai. Then there’s Delhi, Mumbai and Chandigarh, the last of which has a lot of Canada-bound traffic. And then we have Kolkata, in seventh position, which also has a fair amount of interest but not as much as some of the other cities with more engineering colleges.

We want to do for education loans what HDFC has done for home loans

Jainesh wants GyanDhan to do for education loans what HDFC has done for home loans in India Courtesy: Jainesh Sinha

What are your plans for GyanDhan’s growth and expansion? Where do you see it in five years’ time?

We’ve always had a vision of being the banker for Indians going to study abroad. We want to do for education loans what HDFC has done for home loans. In the mid-term, we want to focus even more on the overseas vertical while also trying to expand our domestic vertical wherein we help facilitate loans for upskilling programmes. Over the last six years or so that we’ve been operating, we’ve understood the gaps in the market and also what lenders often miss out on, chiefly in terms of assessing risk and employability. We want to use the insights we’ve got and the NBFC licence to grow GyanDhan as a lender in its own right. We’ll still be associating with other lenders in the future, but once we’ve grown in terms of our own lending potential, we’ll be able to provide even better opportunities to students. At the same time, we’re also in talks with a few lenders to set up a co-lending model, in keeping with the regulations released by the Reserve Bank of India (RBI).

I mostly spend my downtime playing with my daughter and my dog

Let us shift gears and end by finding out a little more about Jainesh, the person. What are your hobbies? How do you like to zone out?

I had a daughter about seven months ago, so my number one hobby is to play with her! Both of us wake up by 5 or 5.30am and play for some time. She’s also coming to that age where it’s really fun to play with her. We also have a little dog, so when I come back in the evening, I mostly spend my downtime playing with my daughter and my dog, who also love playing with each other.