Mumbai, June 18: When Raghuram Rajan had taken over as the 23rd governor of the Reserve Bank of India (RBI) he had famously said that he was not at the central bank to win votes or Facebook likes. But as his eventful tenure draws to a close - during which he has prescribed many bitter pills to restore the health of the financial system - he has ended up with a deluge of "likes".

Rajan took over as the RBI governor at a time when the rupee was under intense pressure and the currency was counted amongst the "Fragile Five". Retail inflation was in double digits and many banks had applied temporary, band-aid solutions to a mounting bad loan problem.

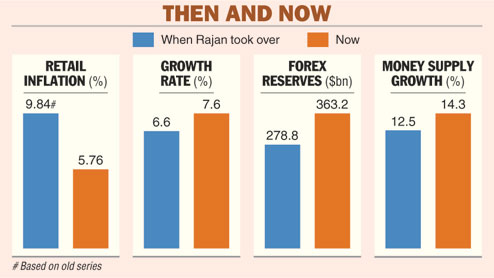

Rajan, who has often been seen as an inflation warrior, has been successful in wrestling retail inflation down to 5.76 per cent in May. The central bank now wants to bring the retail inflation down to 5 per cent by March 2017. Significantly, during his three-year tenure, the central bank chose retail inflation over wholesale price index (WPI) as the key measure of inflation.

On the foreign exchange front, Rajan was successful in bringing back the beleaguered rupee from its depths through a string of measures that included raising over $34 billion in 2013 through foreign currency non-resident deposits and foreign currency borrowings. India's forex reserves now stand at over $363 billion even as the currency was largely stable during his tenure.

However, experts are unequivocal in their view that Rajan will be most remembered for his measures taken to clean up the banking system from the non-performing asset (NPA) menace. During his tenure, the central bank introduced several path-breaking measures to identify those cases which could turn into an NPA and also gave banks the powers to change the management of a defaulting company by converting its debt into equity.

Banks now have the powers to direct entities with huge debt in their books to sell some of their assets, thus enabling banks to recover their loans. Similarly, a panel of lenders called the Joint Lenders Forum (JLF) has also been formed which will have to bring out an action plan to rectify a particular loan.

A determined Rajan did not stop there. After having placed a target of cleaning up bank balancesheets by March 2017, the central bank came out with an asset quality review (AQR) wherein it asked lenders to identify certain advances as bad loans. The net result was that provisions, or the sum set aside by banks to cover these loans, soared during the quarter ended December 31, 2015, and March 31, 2016, and some of the PSU banks reported huge losses. But this measure certainly got a thumbs-up from the markets which saw the "surgery" as being long-term positive for the sector.

Rajan's tenure, observers said, will also be remembered for increasing the number of players in the banking system. While the central bank gave universal banking licence to Bandhan and IDFC, it also opened the doors for niche lenders called payment banks and small finance banks. It subsequently issued licences to 10 small finance banks and 11 entities to start payment banks. The RBI now wants to follow this up by giving banking licences on-tap wherein professionals with 10 years of experience can promote such full-fledged banks, among others.

The all-rounder Rajan will also be remembered for strengthening the payment infrastructure in India through institutions like Bharat Bill Payment System, an integrated bill payment system that will allow customers to pay various bills using a single platform.