The Chatterjee Group (TCG) has bought out the Bengal government’s residual stake in Haldia Petrochemicals Ltd (HPL), owning nearly a three-fourth share of the company and reaffirming faith in a venture that has clawed its way back from dire straits.

TCG picked up 26 crore shares or 15.40 per cent of the stake for Rs 653 crore.

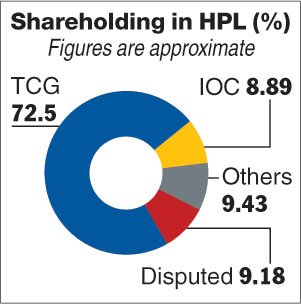

Following the transaction, which took place in mid-September, and transfers among shareholders, TCG’s stake has gone up to 72.50 per cent in one of the most prominent business ventures of Bengal.

The state government has now all but exited the company, except for a disputed block of 15.5 crore shares that account for 9.18 per cent of the stake. The ownership of this passel of shares will now have to be decided by Calcutta High Court with both promoters — TCG and the West Bengal Industrial Development Corporation (WBIDC) — staking claim to it.

According to the master agreement reached between the two parties on December 21, 2015, TCG had agreed to buy out 52 crore shares of the WBIDC in two instalments, leaving it to the court to decide on the disputed shares.

The agreement was an important milestone as it cemented a truce between the two major shareholders and paved the way for the company’s growth.

After acquiring the 26 crore shares, TCG had seven years to buy out the rest of the block. However, the private investor decided not to wait.

“Chatterjee has bought out the government stake with a bullet payment of Rs 653 crore long before the deadline,” a government official said.

TCG, owned by Purnendu Chatterjee, paid Rs 25.10 a share — the same price set two years ago. The terms of the current sale had been laid out in that agreement.

The deal has come through at a time the debt-laden government has been trying to tap every means to raise resources for development programmes.

Indian Oil Corporation and the Tata Group continue to remain invested in HPL.

The change in the fortunes of HPL, the Haldia-based polymer producer, may have prompted TCG to close the deal earlier. In 2014, HPL had teetered on the brink of the sick bay. The Haldia plant was re-started in February 2015, ending a seven-month closure for want of working capital.

According to the annual report of 2014-15, the project saw a “dramatic turnaround” and began full-scale operations by March. This was possible mainly because of the leap of faith by SBI which, led by the then chairperson Arundhuti Bhattacharya, along with other banks, provided a Rs 900-crore working capital facility. The bankers had stepped in after Chatterjee pumped Rs 100 crore into the company.

The business environment also changed. The price of naphtha, the basic raw materialthat HPL uses, plunged from $900 a tonne to $360 after global crude oil prices stayed low till the end of 2017.Rating agency ICRA noted HPL posted a net profit of Rs 863.4 crore in 2016-17 and Rs 102.4 crore in 2017-18.