New Delhi: The Narendra Modi government finally has something to crow about with Moody's Investors Service, the New York-based global credit rating agency, upgrading its rating on India's sovereign bonds for the first time in nearly 14 years.

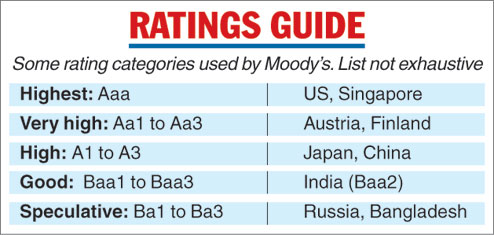

The agency said it was lifting India's rating to Baa2 from Baa3 and changing its rating outlook to "stable" from "positive" as it reckoned that the risks to the credit profile were "broadly balanced". Baa3 is the lowest rating in the investment grade - just a notch above junk bond or speculative status.

Moody's expressed its belief that continued progress on economic and institutional reforms would enhance the country's high growth potential.

It expressed faith in the pace of changes, including the introduction of the GST, demonetisation, measures to tackle bad loans and the attempt to push the envelope on Aadhaar - all of which have drawn fire from opponents of the government.

This is the first ratings upgrade for India by Moody's since January 2004. India is now on a par with Italy and Philippines and a notch above Indonesia. "We welcome this upgrade," finance minister Arun Jaitley said. "We believe that it is a belated recognition of all the positive steps which have been taken in India in the last few years."

The ratings upgrade could reduce the cost of overseas borrowings for Indian companies by as much as a quarter percentage point. Stocks surged and the rupee hardened as the markets reacted with exuberance.

Growth forecast

Moody's forecast real GDP growth this year at 6.7 per cent - broadly in line with the projections made by the IMF and the RBI - and expected it to rise to 7.5 per cent next year. "India's growth potential is significantly higher than most Baa-rated sovereigns," it added.