For individual taxpayers, the keyword in this year’s interim budget is “rebate” and not “exemption”.

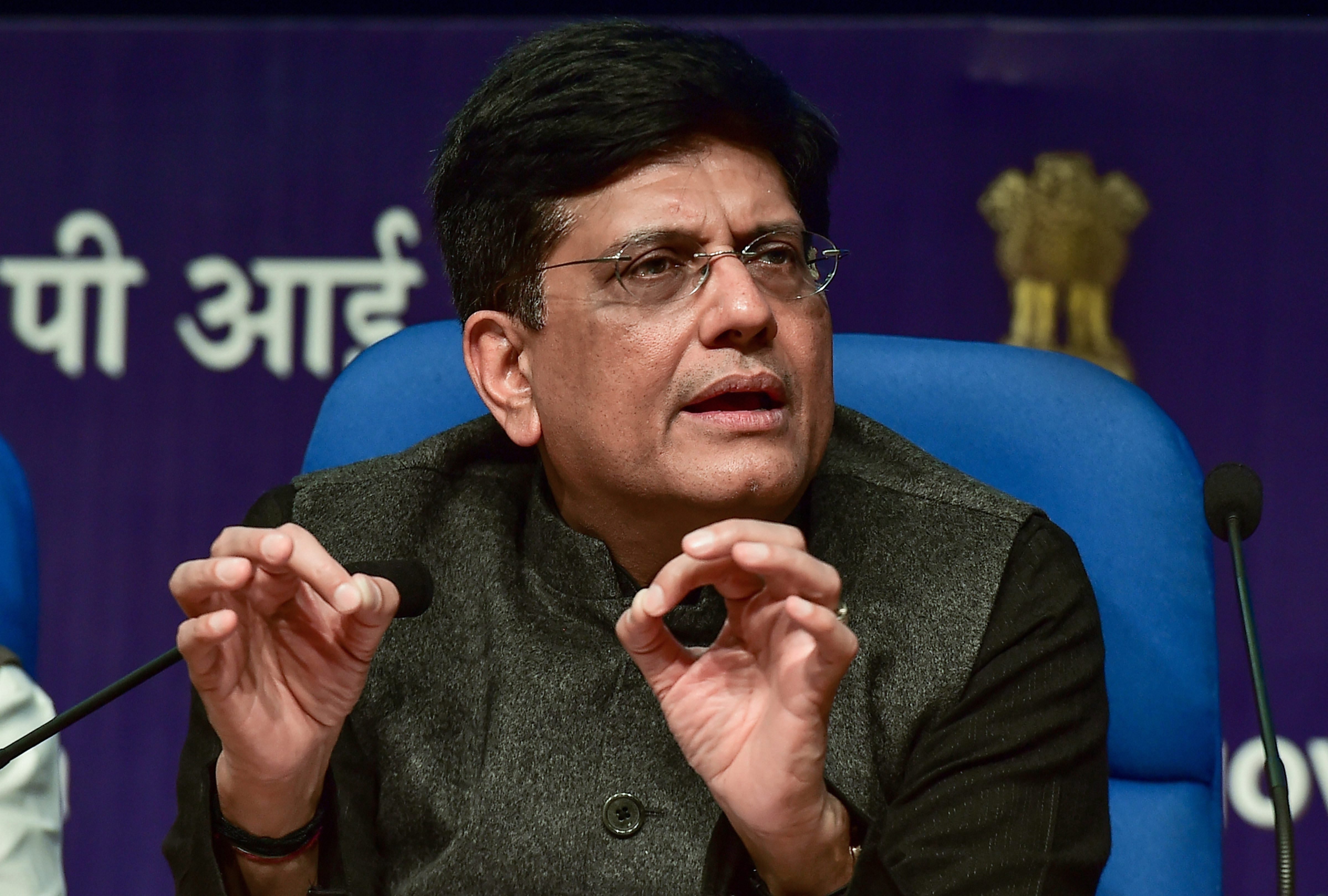

In the “interim” Union budget, stand-in finance minister Piyush Goyal announced that individual taxpayers with an annual taxable income up to Rs 5 lakh will get a full tax rebate and will, therefore, not have to pay any income tax.

The announcement sparked immediate elation but a glum mood set in when tax experts explained the true import of the tax proposal. There has been no increase in the basic exemption limit from Rs 2.5 lakh to Rs 5 lakh.

An exemption, unlike the rebate, would have kept income up to Rs 5 lakh for all out of the tax net, and the tax would have applied only to the excess amount.

A quick reading of Finance Bill 2019 shows that the government has proposed the change under Section 87A whereby the rebate under this section has been increased from Rs 2,500 to Rs 12,500, covering taxpayers having income up to Rs 5 lakh per annum.

In the last budget, Arun Jaitley had introduced a standard deduction of Rs 40,000 with the withdrawal of the exemption for conveyance allowance and medical reimbursement. Goyal has now increased the standard deduction limit to Rs 50,000.

So, what kind of savings can the 30 million taxpayers who fall in this category realistically expect?

The tax liability for an individual with an annual taxable income of Rs 6.5 lakh in 2018-19 was Rs 10,920 after considering the 80C exemption of Rs 150,000, the standard deduction of Rs 40,000 and the health and education cess of 4 per cent. In 2019-20, the tax burden will become nil because of the rebate.

So, the individual saves Rs 10,920 a year or Rs 910 a month.

“Even persons having gross income up to Rs 6.50 lakh may not be required to pay any income tax if they make investments in provident funds, specified savings, and insurance,” Goyal said, referring to the Section 80C deductions, available up to Rs 1.5 lakh.

“In fact, with additional deductions such as interest on home loan up to Rs 2 lakh, interest on education loans, National Pension Scheme contributions, medical insurance, medical expenditure on senior citizens, persons having even higher income will not have to pay any tax,” Goyal said.

According to tax analysts, after considering the standard deduction, interest on housing loan of self occupied property, exemption under 80C, investment in NPS and the exemption under 80D (medical insurance), salaried taxpayers with income up to Rs 9.75 lakh may tumble out of the tax net.

Goyal said an estimated 30 million or 3 crore middle-class taxpayers, made up of the self-employed, small businesspeople, small traders, salary earners, pensioners and senior citizens, are expected to benefit from the move. Government data show there were around 7 crore individual taxpayers in assessment year 2017-18.

“The Income Tax Act provides that to claim rebate under Section 87A or deduction under Section 80C, one has to file an income-tax return. So, the 30 million taxpayers who are going out of the tax bracket will still have to file returns,” said Narayan Jain, co-chairman, direct taxes committee, the All India Federation of Tax Practitioners.

“The rebate will certainly benefit a section of individual taxpayers,” said Arvind Agrawal, chairman, direct tax committee, Merchant Chamber of Commerce and Industry.

Other changes

The threshold for tax deduction at source (TDS) on the interest earned on bank/post office deposits has been proposed to be raised from Rs 10,000 to Rs 40,000.

Further, the TDS threshold on rent has been proposed to be increased from Rs 180,000 to Rs 240,000 in order to provide relief to small taxpayers.

At present, the benefit of capital gains tax exemption under Section 54 is available if the taxpayer invests the long-term capital gains arising from the sale of a residential house property in the purchase or construction of “one” residential property within the specified period.

The restriction of investment in “one” residential house is proposed to be increased to “two” residential houses for a taxpayer with capital gains up to Rs 2 crore. This benefit can be secured only once in the taxpayer’s lifetime.

“This move will also incentivise the real estate sector at large, and benefit middle-class taxpayers,” said Suresh Surana, founder of RSM Astute Consulting Pvt Ltd.

The Telegraph