New Delhi, May 24: Incense stick makers in the country are quite simply incensed.

The big stink is over the new goods and services tax (GST) regime that is expected to kick in from July 1.

The humble agarbatti - the aromatic incense stick that is integral to ritual worship in several religions - will attract a 12 per cent GST rate.

The rate has ignited resentment against the Narendra Modi government for reneging on a commitment it had apparently made to Uttar Pradesh chief minister Yogi Adityanath that " puja samagri", or items used in ritual worship, would be exempt from the indirect tax that seeks to bind the nation into a gigantic common market.

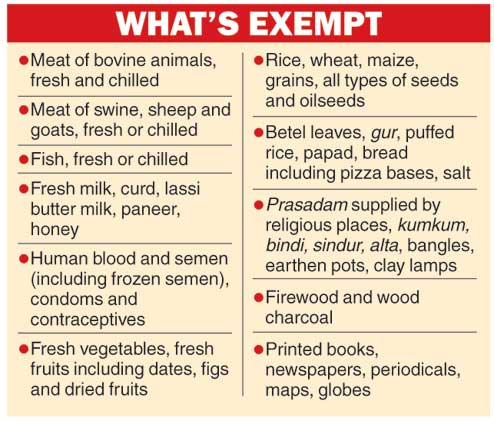

Incense makers may find that what really gets their goat is the fact that the meat of bovine animals is exempt from GST, in spite of the near-hysteria over slaughterhouses that has swept through northern India.

It is hardly any solace that attar - essentially distillates of flowers, herbs and spices that also have spiritual use and are believed to ward off evil spirits - will be taxed at 18 per cent.

Smouldering joss stick makers met finance ministry officials to protest against the levy and persuade the government to treat them on a par with the prasadam offered by places of worship, kumkum, bindi and earthen clay pots - all of which have been exempt from the GST levy.

"Now, agarbatti attracts zero excise tax and zero VAT in most states. We were expecting the GST levy on agarbattis to be either zero or 5 per cent," Sarath Babu, president of the All India Agarbatti Manufacturers Association, told reporters after a meeting with revenue secretary Hasmukh Adhia.

The use of incense sticks has a hoary tradition, dating back to Vedic times when these were exclusively made by monks and used to dispel unpleasant odours before any ritual. Incense sticks find mention in the Rig Veda and Atharva Veda. A uniform and codified system of incense-making is believed to have started in this country and then exported to Japan, China, Tibet and Nepal, where they are called joss sticks.

The agarbatti - a dollop of incense paste wrapped around a bamboo stick - has now turned into a thriving cottage industry. Babu believes that the 12 per cent GST rate will knock the bottom out of the small manufacturing units and cannot understand why the compulsions of revenue are being used to smother the embers of piety.

The problem arises because of classification under the GST. Agarbattis are lumped under Chapter 33, which covers essential oils and resinoids, perfumery, cosmetic or toilet preparations. This chapter also covers kumkum, bindi and sindoor that are treated as exempt items.

Prasadam comes under Chapter 21 (miscellaneous edible oil preparations) and is exempt. It shares the rack with sweetmeats, coffee and custard powder that attract higher rates.

Not agarbattis, which have been bracketed in the 12 per cent category. Stacked above the sticks are hair oils, toothpastes and soaps (which will attract an 18 per cent levy) and sunscreen lotions, shampoos, hair cream and dental floss (which will be charged 28 per cent).

India produces about Rs 3,000 crore worth of incense sticks and exports about Rs 400 crore worth annually to almost all countries across the globe. Importers of Indian incense sticks range from the US, the UK, the European Union to Iran, Paraguay and the Middle Eastern emirates.

"We thought that the zero tax on puja samagri would cover us ... but that does not seem to be so. We are in the higher 12 per cent bracket, not even in the concessional 5 per cent category," said Ankit Aggarwal, director of Mysore Deep Perfumery House. "This will certainly hit many of us very hard."

Some 10,000 units directly and indirectly employ 25 lakh people, mostly women, who make incense sticks in tiny factories spread over Karnataka, Maharashtra, Madhya Pradesh, Odisha and Delhi.

"Women constitute close to 90 per cent of the workforce and 80 per cent of them work from home. We plead with you to protect our industry as a 12 per cent increase in absolute cost will directly reduce consumption resulting in millions of people losing their source of livelihood," the association said in a memorandum.

Aggarwal said individual members have been lobbying their respective state finance ministers but their pleas have not been heard.

Incense stick makers range from Banwasi Seva Ashram (Tribal Welfare Mission) under the Khadi and Village Industries Commission to Auroville in Puducherry, from tiny factories to the Calcutta-based giant ITC.