New Delhi, May 19: Airline travel and accommodation in five-star hotels could become slightly cheaper but insurance premiums and transactional fees on securities purchases will rise when the goods and services tax (GST) regime kicks in from July 1.

The GST Council today surprised industry by coming out with a four-slab GST rate structure for services at the end of a two-day meeting in Srinagar.

The four rates will be 5, 12, 18 and 28 per cent -- closely mirroring the rate structure for manufactured goods. Industry had expected most services to be bundled into just two slabs: 12 and 18 per cent.

Healthcare and education will be exempt from the GST on services.

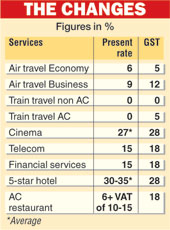

Revenue secretary Hasmukh Adhia said economy-class airline tickets would be charged a GST rate of 5 per cent, slightly lower than the existing service tax of 6 per cent. Business-class tickets will attract a GST rate of 12 per cent.

For railways, second-class travel will be exempt from the GST while AC passenger travel will be taxed at 5 per cent. Railway freight services will also be charged at 5 per cent.

"The net effect of the GST will not be inflationary," finance minister Arun Jaitley asserted. The council had fixed the GST rates for over 1,200 manufactured goods yesterday.

The tax rates on gold, beedis, biscuits, textiles and footwear have not been decided yet. The council will meet again on June 3 to set these rates and decide on other procedural formalities relating to the GST rollout.

Although five-star hotels will levy the peak GST rate of 28 per cent, Jaitley said this would be lower than the existing rates that range between 30 and 35 per cent, arising from a combination of service tax and varying state luxury taxes.

Hotels with a room tariff of Rs 1,000-2,500 will levy a GST rate of 12 per cent while those with a rate of less than Rs 1,000 will be exempt from the national levy.

Hotels with a room tariff between Rs 2,500 and Rs 5,000 (mostly three- and four-star hotels) will fall within the 18 per cent bracket.

"A lower tax rate for the budget hotels sector will ensure that the industry's quality upgrade continues. It will also save and create thousands of new jobs. The industry is expected to contribute $280 billion to the GDP by 2026 and will pass on the benefits of uniform taxation across the country to travellers," said Ritesh Agarwal, founder & CEO of OYO.

However, a section of the travel trade and hoteliers were upset over the differential tax treatment of hotels. "This suggests that staying in a five-star hotel is a sin. If we are to encourage tourism, we need to bring down hotel prices to levels that are closer to our Southeast Asian rivals', not raise them," said Krishnalekha Ghosh, CEO of travel firm GlobeAir Ltd.

The top rate of 28 per cent will be levied on cinema tickets, race clubs and betting counters. Experts said cinema ticket prices could dip in Mumbai, where current levies hover around 40 per cent, but not in other cities.

Mobile phone bills could rise too because the GST rate has been set at 18 per cent, prompting telecom players to moan about the growing stress in a sector that is already bleeding.

"We are disappointed with the announced rate of 18 per cent. We had submitted to the government that consideration must be given to the present financial condition of the sector, and any rate beyond the existing rate of 15 per cent makes the telecom services more expensive for the consumer," said Rajan S. Mathews, director-general of the Cellular Operators Association of India.

"This is also likely to slow down the planned rollout of infrastructure across the country and will have an impact on the government's flagship initiatives like Digital India and Cashless India."

Taxi aggregators like Ola and Uber will breathe easy. The GST rate on their services has been fixed at 5 per cent against the existing 6 per cent. The big fear was that they would be bundled into the 12 per cent category, which would have impacted ride prices.

"There was an expectation that certain parts of the banking, financial services and insurance (BFSI) sector may be classified under the lower rate of 12 per cent, especially life insurance. This would have probably given some impetus to improve penetration of such services across the country," said Divyesh Lapsiwala, tax partner for financial services at EY India.

"ATMs appear to be now classified under the 28 per cent category. In such a case, banks will lose 14 per cent of the cost incurred in relation to ATMs, thereby increasing the cost of deployment."

V.S. Datey, senior consultant with Taxmann, said: "The present tax rates have been broadly continued with marginal adjustments. The existing service tax exemptions are also being continued. (But) the GST rate for banking and financial services has been hiked from 15 per cent to 18 per cent. In fact, there is a case to reduce it to 12 per cent as it is a core sector for the economy."

E-commerce giants Amazon and Flipkart will deduct 1 per cent as tax deducted at source from suppliers once the GST rolls out. Works contracts -- contracts for supply of goods and services -- will attract a 12 per cent GST rate.

Sachin Menon, national head (indirect tax) at KPMG India, said: "The multiplicity of tax rates for services will add complexity to compliance in the GST regime."

Economists had earlier forecast that the GST could result in a 2-2.5 per cent increase in the country's GDP. But the decision to set multiple rate slabs and cap them at current effective rates means the government will be hoping to see tax buoyancy mainly from removing the tax anomalies that have impeded free movement of goods and services across state borders.

"That we have enacted a GST and brought all the states together is a plus for the India story. However, the near-equalisation of the GST rates with the current effective rates of taxation means the big boost we were expecting through the introduction of this measure will be delayed," said Biswajit Dhar, a professor at Jawaharlal Nehru University's Centre for Economic Studies and Planning.