The stunning rise of US technology stocks this year has sent the fortunes of America’s richest immigrant billionaires soaring, and at the forefront are Indian-born entrepreneurs and executives who now dominate Forbes’ ranking of immigrant tycoons.

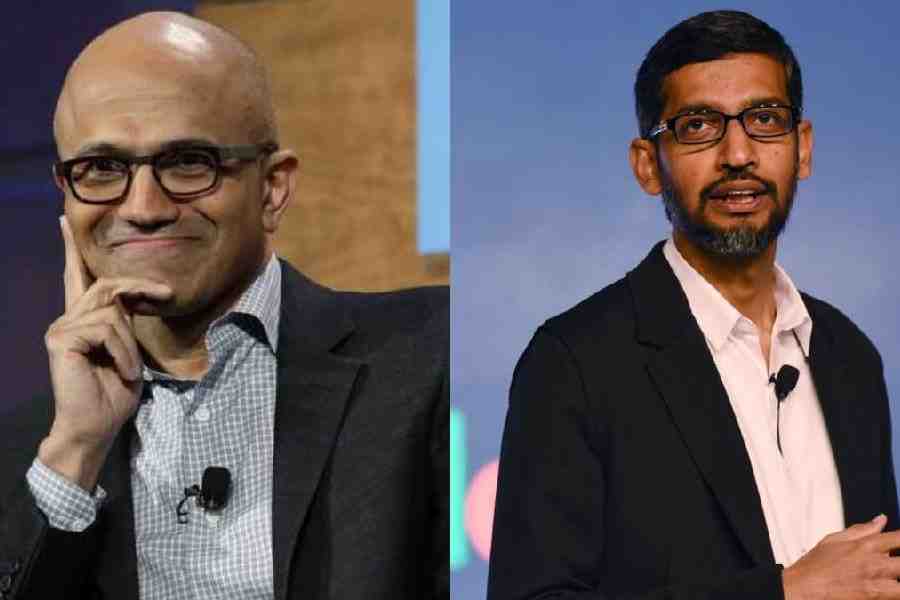

Their clout was on display last week at the White House, where five Indian-born leaders were among the two dozen tech titans invited to dine with President Donald Trump. Microsoft’s Satya Nadella, Google’s Sundar Pichai, Micron Technologies’ Sanjay Mehrotra, TIBCO chairman Vivek Ranadive, and Palantir CTO Shyam Sankar all had a seat at the table. Their presence, a fifth of the guests, was a striking signal of how deeply Indian-origin executives now shape the US technology agenda.

Forbes’ latest tally of 125 foreign-born US billionaires shows that 12 hail from India, pushing past earlier leaders like Israel and Taiwan. Their combined wealth reflects not only Silicon Valley’s stellar year but also the deepening role Indian talent plays in corporate America and Washington policymaking.

The five new Indian-born entrants to the Forbes list include some of tech’s most familiar names. Nadella, Microsoft’s chief executive, and Pichai, who leads Google parent Alphabet, are each now worth $1.1 billion. Palo Alto Networks CEO Nikesh Arora has amassed $1.4 billion, his fortune propelled by the cybersecurity boom.

Another new face is Rajiv Jain, founder of investment powerhouse GQG Partners, who made headlines in 2023 with a $4 billion bet on India’s Adani Group amid wider controversy over the conglomerate’s governance. A year later, those investments had ballooned in value to $11 billion. Between January and March this year, GQG put another $2 billion into Indian companies including Bharti Airtel and HDFC. Jain told Moneycontrol in May that GQG’s assets had almost doubled in three years and the firm was now “overweight on India.” In total, GQG ploughed $2 billion into India through 2024, making Jain one of the most powerful bridges between Wall Street and Mumbai.

Also joining the billionaire ranks is Raj Sardana of Atlanta-based Innova Solutions, worth $2 billion. Sardana’s story has the ring of an immigrant parable: he arrived in the US with just $100, worked in the Georgia Tech cafeteria, and built a company that now spans the globe.

Topping the Indian contingent is Jay Chaudhry, founder of cloud security giant Zscaler, worth a staggering $17.9 billion. Born in a Himachal Pradesh village of 800 people without electricity or running water, Chaudhry walked four kilometres each way to school but he still managed to make it to IIT-BHU. His first plane journey was to the US but the relatively humble start didn't stop him from becoming a hi-tech star. Now based in Reno, Nevada, Chaudhry has also turned philanthropist, channelling millions back into education and infrastructure in his home district.

Not all Indian-born billionaires built their fortunes solely in software. Rakesh Gangwal, co-founder of IndiGo Airlines, now worth $6.6 billion, made his money in aviation. Gangwal, a Wharton graduate who worked at United Airlines, Air France, and later became CEO of US Airways, has been selling down his IndiGo stake. His most recent move—a planned $801 million share sale—will take his holding below 5 per cent.

Another long-time billionaire is Romesh Wadhwani, now worth $5 billion. Born in Karachi but raised in India after Partition, Wadhwani studied at IIT Mumbai before moving to the US and building Symphony Technology Group. He and his brother Sunil have established the Wadhwani Impact Trust and the Wadhwani Institute for Sustainable Healthcare, both focused on transforming health and education systems in developing economies.

Vinod Khosla, worth $9.2 billion, co-founded Sun Microsystems in the 1980s before turning to venture capital. Khosla has since become one of the most active investors in clean tech, backing dozens of companies in renewable energy, carbon capture, and alternative fuels.

Jayshree Ullal, chief executive of Arista Networks, is worth $4.8 billion. Born in the UK to Indian physicist parents but raised in New Delhi, she moved to the US, built a career at Cisco and AMD, and rose to lead Arista, a cloud networking giant. Ullal also founded the Sita Foundation, supporting cancer research, social welfare, and hunger relief in India.

At the very top of Forbes’ immigrant billionaire list stands Elon Musk, born in South Africa, with a fortune of $393.1 billion. Musk’s wealth has oscillated sharply, peaking at $430 billion, but his latest coup, a deal projected to earn him as much as $1 trillion over the next decade, keeps him far ahead. Google’s Sergey Brin, born in Russia, is second at $139 billion, while Nvidia’s Jensen Huang, born in Taiwan, is third at $137.9 billion.

Musk and Huang are defining figures of the US tech economy. Nvidia’s chips are indispensable for AI firms, while Musk remains a lightning rod with Tesla and SpaceX at the centre of both Wall Street and Washington debates.

Of the 125 immigrant billionaires in this year’s Forbes list, two-thirds made their fortunes in technology (53) or finance (28). Together, they are worth $1.3 trillion, roughly 18 per cent of America’s total billionaire wealth of $7.2 trillion.

When the list was last compiled in 2022, it counted 92 names, with Israel and Taiwan topping the ranks. The rise of Indian-born billionaires in just three years is a measure of how decisively the balance has shifted.

Beyond numbers, Indian-born billionaires are shaping US corporate agendas and, increasingly, policy debates. Nadella and Pichai are regular fixtures in Washington as lawmakers wrestle with regulating AI. Khosla has been a vocal advocate for aggressive climate tech subsidies. Jain’s bets on Indian companies make him a bridge between Wall Street capital and New Delhi’s industrial champions.

Last week’s White House dinner with Trump underscored that influence. Nadella, Pichai, Mehrotra, Ranadive, and Sankar were among the two dozen top executives summoned to discuss AI, data security, and global competition.

Why do immigrant entrepreneurs punch so far above their weight? Israel-born venture capitalist Oren Zeev, also on the Forbes list, offers one explanation: “What helped me succeed, I believe, was that thanks to my different background, I was able to think and operate differently than most VCs who went to the same schools, hung out with each other and influenced each other. I found it easier to be contrarian, which of course could be a big positive in venture capital.”

That contrarian streak is visible in Indian-born success stories too, from Jain’s bold Adani bet at the height of controversy to Chaudhry’s vision for cloud security.

In total, the list reveals not just who is winning in Silicon Valley’s great wealth race but how Indian-born leaders are reshaping American business and finance. With fortunes tied to AI, cybersecurity, and India-linked investments, their rise signals a deeper shift: at a time of rising racial prejudice, America’s immigrant elite is increasingly speaking with an Indian accent.