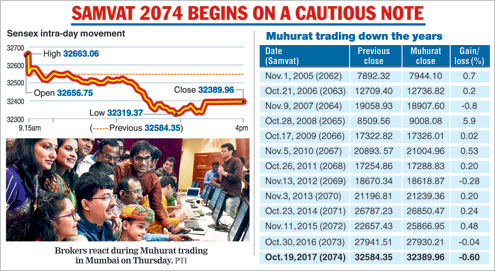

Mumbai: Samvat 2074 started on a rather dull note on Thursday with the Sensex dipping over 194 points and the Nifty losing 64 points as banking stocks continued to bleed and global cues remained weak.

At a special one-hour Muhurat session to mark the start of the new year, stocks witnessed a sudden sell-off despite opening on a positive note.

The 30-share Sensex, which opened at 32656.75 and hit the session's high of 32663.06, came under pressure after 30 minutes of trade. The index soon slipped to 32319.37 before closing at 32389.96, down 194.39 points, or 0.60 per cent.

Likewise, the broad-based NSE Nifty index, after swinging between 10211.95 and 10123.35, ended 64.30 points, or 0.63 per cent, lower at 10146.55.

Barring five stocks, the rest of the Sensex pack ended with losses.

Banking counters remained in weak territory with shares of ICICI Bank dropping nearly 2 per cent and Kotak Mahindra Bank, 1.64 per cent. HDFC Bank and the SBI, too, finished in the red.

Market circles said this was on account of bad loan worries in Axis Bank numbers. This apart, participants booked profits in heavyweights such as Reliance Industries, HUL and Tata Steel.

The Sensex had gained 4642.84 points, or nearly 17 per cent, in Samvat 2073.

While there are valuation concerns, experts point out that it was too early to say whether the opening on Thursday was the shape of things to come. This is because the Muhurat session usually sees token buying by participants as they open their new accounts.

A key question, however, remains. Will the current year see the long awaited revival in corporate earnings?

Coming after a year that saw the benchmark indices rising over 16 per cent largely on liquidity play, experts point out that an improvement in the corporate scorecard will be a crucial factor in determining the market's course during the current trading year.

While there is no unanimity on when this will happen, a few optimists say early signs of a revival may be visible in the January-March quarter or April-to-June quarter of the next fiscal.

"Last Samvat, strong domestic flows played a major role in driving equity values. Though this liquidity may continue in the current year, if corporate earnings do not improve over the next few months, it could turn into very bad news for the markets,'' an analyst with a foreign brokerage warned.

Such a forecast comes at a time companies have so far reported mixed numbers for the September quarter. Even Axis Bank shocked the Street with a sharp jump in bad loans, TCS, Wipro and Reliance brought some cheer. Investors, however, remain concerned about the tepid corporate performance.

"The persistent weakness in top line growth of coverage, excluding banks and commodities, is worrying,'' a note from Edelweiss Securities said.

Amid concerns of high valuations in certain pockets, brokerages point out that investors should take a stock-specific approach and they should also look at sectors that hold strong potential.

Analysts aver that consumption, metals, and select financials could see gains in the current year.

"We expect market returns in the new Samvat to be higher than the previous one. We are positive on select stocks in the consumption space,'' Dipen Shah, senior vice-president & head of private client group research, Kotak Securities, said.

Vikas Inder Jain - senior analyst, Reliance Securities, says investors should use any decline or a consolidation for a fresh entry and keep accumulating, as and when such opportunities present themselves.