Mumbai, Aug. 31: The Reserve Bank of India today named the State Bank of India and ICICI Bank as the country's systemically important banks to be subject to additional equity requirements.

Domestic systemically important banks (D-SIBs), similar to "too big to fail" lenders in some of the overseas countries, became the subject of discussion following the global financial crisis of 2008 where problems faced by certain large and highly interconnected financial institutions affected the functioning of the entire financial system.

The authorities had to intervene in many jurisdictions to bring about financial stability. However, the cost of such an intervention led to policies to reduce the risk of failure of such banks.

Following this, in 2010 Switzerland-based Financial Stability Board (FSB) recommended that all member countries should put in place a framework to reduce risks attributable to such institutions in their jurisdictions.

Later, the Basel Committee on Banking Supervision (BCBS) came out with a framework to identify these lenders.

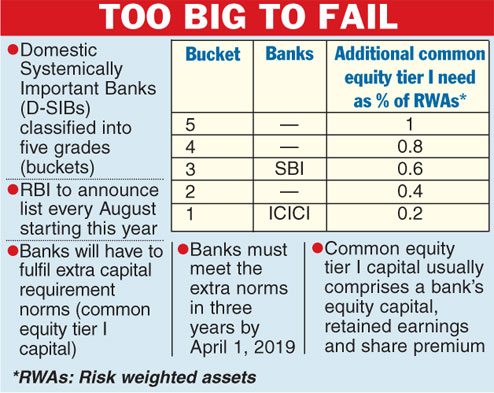

The RBI had in July last year released the framework to deal with D-SIBs in India. According to this framework, the RBI will disclose the names of banks designated as D-SIBs every year in August starting from this year. Though the apex bank was expected to name 5-6 banks as D-SIBs, it only named two. Banking circles expect the number to go up next year.

The framework put in by the RBI requires D-SIBs to be placed in various buckets depending upon their systemic importance scores (SISs). Based on the bucket in which a D-SIB is placed, an additional common equity requirement has to be applied to it. The lender with the highest score will have to bring in more equity capital as a percentage of their risk weighted assets.

The RBI has put in a five-bucket structure. Of this, ICICI Bank is in the first bucket, while the SBI falls in the third.

The additional equity requirement norms will be applicable to these banks from April 1, 2016, in a phased manner and will become fully effective from April 1, 2019.

"Given our size and significant presence across the financial sector, it was expected that ICICI Bank would be classified as systemically important. The bank's capital adequacy is well in excess of regulatory requirements and the bank is not expected to require fresh equity capital for the next couple of years," managing director and chief executive officer Chanda Kochhar said soon after the RBI announcement.

SBI chairperson Arundhati Bhattacharya pointed out that the PSU lender had a much higher level of tier I (core capital) at 9.62 per cent against 7 per cent required under the current guidelines. "We will adhere to the additional requirements as and when they become applicable," she added.