Investors have been gripped with fear and anxiety in the current market scenario. Several macro and micro factors have caused the markets to fluctuate.

Correction in the broader markets started earlier this year around February-March, while the Nifty continued to chug along aided by surges in select heavyweights. The rupee was on a decline from August because of tightening of rates in the US and surge in oil prices.

When the storm hit

The perfect storm hit the markets in September when one of our premier financial institutions defaulted on some of its debt obligation. This was a scathing attack on an already fragile market at a time of the year when liquidity runs dry because of advance tax payments and half yearly closing. In the face of such news, investors may find themselves taking impulsive decisions or conversely, becoming paralysed and unable to implement an investment strategy.

During bull markets, there is an illusion of calm and stability which may push us to take more risks than desired. Hence, this is the time to rethink your ability to take risks and reallocate at an opportune time.

It is very important to have long-term perspective and discipline as these qualities help investors to remain committed to their investment objectives through periods of market uncertainty like the one we are seeing now.

While equity offers superior returns in the long run, it also exposes one to certain volatility inherent in the nature of the asset class. You cannot have one without the other. This is what the markets are witnessing now. So what does one do in such a scenario? Does one react to random movements of the market or can one prepare in advance to wade through volatile times?

Allocation is key

This is where your asset allocation and investment charter come into the picture. Prudent allocation to multiple asset classes not only minimises an investor’s risk, but also makes returns more predictable and consistent.

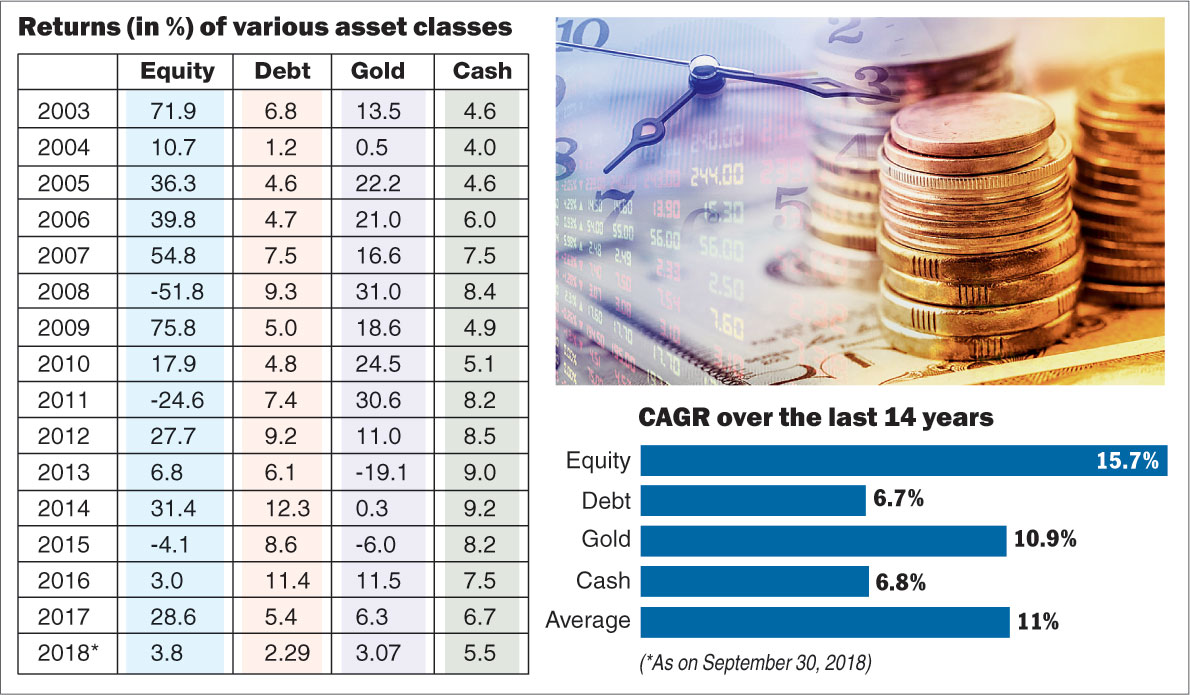

Let us substantiate this with some data. If one were to compare the performances of different asset classes such as equity, debt, gold and cash over the past 14 years, one would observe that no asset class has been a consistent winner (although equities outperformed most of the time).

Yet, if one had allocated one’s portfolio equally among these asset classes for the said period, one would have made an average return of around 11 per cent (see chart), which is way above tax-free bonds. More so, there has been only one instance, in 2008, where the strategy gave negative returns, that too very marginal. This was because of the global financial crisis in 2008 when most of the markets were battered.

Thus, there is clear merit in diversifying investments across asset classes as it reduces dependence on a single asset class and protects one from market turbulence. Based on your risk taking appetite, one should decide on how much money needs to be allocated to different asset classes.

(Telegraph)

Risk tolerance level

There are multiple factors that define your risk tolerance level such as the investment horizon, liquidity needs, investment goals etc. An investor with high risk tolerance may be willing to accept greater volatility in pursuit of higher returns and may allocate a higher percentage of the portfolio towards higher risk assets.

On the other hand, an investor with low risk tolerance may have to forego higher returns for a steadier and less volatile portfolio. If one selects a portfolio with equity and fixed income, the potential gains that the equity component can give are much higher and the associated risk can be taken care of by the fixed investment component.

Thus, a portfolio invested across asset classes has the ability to generate superior risk-adjusted return.

Investment charter

An investment charter makes the approach more full-proof. But first, where does an investment charter fit in and what are its benefits?

In the current investment world, investors seek advice from multiple advisers who, more often than not, have limited understanding of the overall assets. An investment charter lays down tailor-made rules for your portfolio to achieve your long-term goals. It increases the probability to reach your goal by ensuring that you adhere to a suggested allocation over time and varying market environments.

Besides helping you reach your goals, an investment charter attempts to mitigate various portfolio level risks, including impulsive calls. To ensure that undue risk is discouraged and emotions are kept away while making investment decisions, it lays down the broad guidelines for asset class levels, managers, credit and locked-in products.

Although asset allocation is one of the cornerstones for achieving an objective, it only works if the allocation is adhered to over time and through varying market environments. The allocation should be periodically checked keeping the investment charter in mind and the portfolio should be rebalanced if it deviates by more than an agreed percentage from the target.

A combination of a well-planned asset allocation ratio along with a custom investment charter is the way to plan for one’s financial goals. While asset allocation provides superior risk adjusted returns, an investment charter will ensure the discipline required to see one through any potential turbulence. A sturdy foundation provides shelter during storms and asset allocation is that foundation which one can bank on in turbulent times.

The writer is executive vice-president and head-investments, Motilal Oswal Wealth Management Ltd