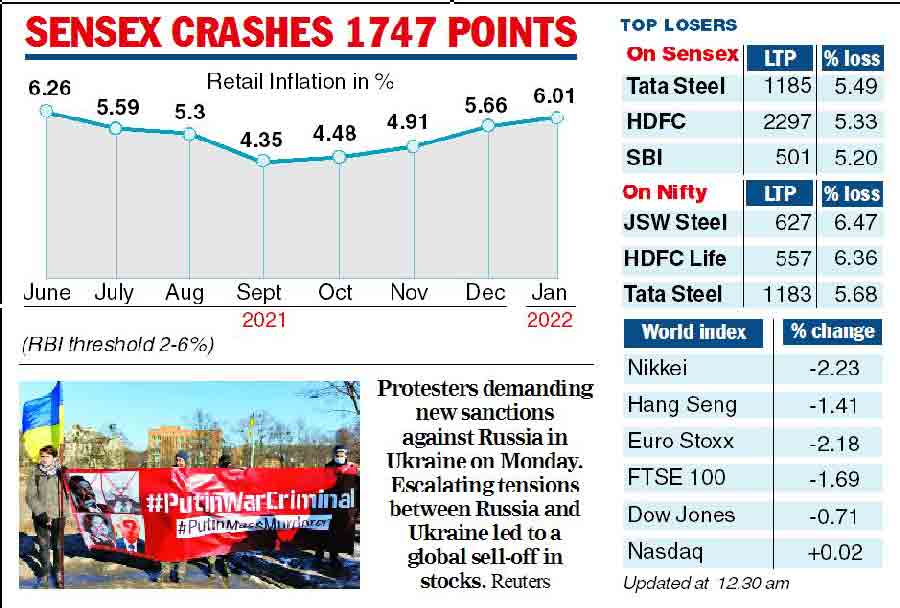

Benchmark indices did not come up smelling of roses on Monday — Valentine’s Day — as they sank over 3 per cent amid a global sell-off fuelled by escalating tensions between Russia and Ukraine.

The Sensex nosedived 1747.08 points — its biggest single-day drop since February 26, 2021 — to end below the 57000 level at 56405.84.

The BSE bellwether crashed 1857.22 points to hit an intra-day low of 56295.70.

The broader Nifty settled sharply lower 531.95 points, or 3.06 per cent, to end below 17000 at 16841.80.

While the Sensex has lost 2520.19 points in just two sessions, investor wealth as measured by market capitalisation eroded by Rs 8.47 lakh crore on Monday.

Investors fear a Russian invasion of Ukraine is imminent resulting in sanctions by US and Europe on Moscow that will jack up crude oil prices. Since Russia is the world’s third largest oil producer, any sanctions will disrupt supplies of the crucial feedstock from the country.

World oil prices will rise, stoking inflation and affecting the global economic growth.

Brent crude oil price on Monday hit an 8-year-high of $96.16 per barrel, though prices steadied later. Analysts said crude at $100 per barrel was a foregone conclusion, and some even said it would touch $120 per barrel.

Rising oil prices will add to the dilemma of central banks the world over as they are already battling inflation caused by factors such as low interest rates.

In India, rising crude price will push up inflation as 80 per cent of country’s crude requirements are imported.

“The Nifty remains under pressure due to rising crude oil prices, the Russia-Ukraine conflict, fear of fast rate hikes across the globe and subdued corporate results. Any relief on the Russia-Ukraine front could result in a temporary bounce which offers an opportunity to sell stocks,” said Deepak Jasani, head of retail research, HDFC Securities.

In the Sensex pack, barring TCS, all shares closed with steep to moderate losses. Tata Steel was the biggest laggard, tumbling 5.49 per cent, followed by HDFC, SBI, ICICI Bank, IndusInd Bank, Kotak Bank and Maruti, which crumbled up to 5.33 per cent.

The Nifty smallcap 100 index tumbled 4.44 per cent and the Nifty mid-cap index was down 3.94 per cent.

The crash pulled down some of the recently listed stocks with counters such as One97 Communications, the parent of Paytm, Zomato, Star Health, and FSN E-Commerce, which owns the Nykaa brand, hitting new 52-week lows in intra-day trades.

There was more bad news for the domestic investor after market hours as the CPI (consumer price index) inflation crossed the upper bound of 6 per cent in January.

Rupee dips

The market crash had its impact on the rupee which fell 24 paise to close at an over nine-week low of 75.60 against the dollar. The unit opened at 75.53 against the greenback and later dropped to a low of 75.64. It finally ended the day at 75.60, the lowest closing level since December 20.