Mumbai, Oct. 3: The Securities and Exchange Board of India (Sebi) today imposed a penalty of Rs 6 lakh on Piramal Enterprises Ltd (PEL), its chairman Ajay Piramal as well as his wife Swati and daughter Nandini for lapses during the sale of the domestic formulation business to Abbott in 2010.

Piramal Healthcare (now known as Piramal Enterprises) had sold the business to the US-based pharma company in a $3.72-billion deal.

The market regulator had investigated into the alleged irregularities in the PEL scrip for violations of insider trading norms.

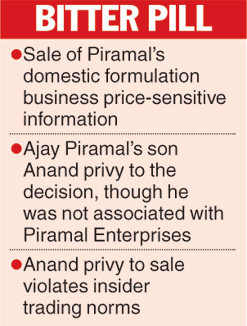

Sebi said the sale of the formulation business was a price-sensitive information till it became public.

The information came into public domain on May 21, 2010, when PEL informed the stock exchanges.

It is alleged that Piramal Enterprises and four other entities, including N. Santhanam, who was earlier the CFO, failed to handle the unpublished price sensitive information (UPSI) of the transaction on a "need-to-know" basis as Anand Piramal (son of Ajay Piramal), who is neither an employee nor a director, was privy to the decision at every stage and, therefore, violated insider trading norms.

"It is necessary to ensure that UPSI is shared strictly on a need-to-know basis and not communicated to others who are not involved in the transaction, irrespective of their position in the company or relationship with the promoters and senior management. The noticees failed to exercise discretion and due diligence and should have avoided sharing of information with Anand Piramal," S.V. Krishnamohan, chief general manager and adjudicating officer of Sebi, said in the order.

Also, the entities failed to implement the model code of conduct by not closing the trading window during the time the sensitive information was unpublished and open it only 24 hours after the information was made public.

The five entities "shall be liable jointly and severally" to pay the penalties, the order said.