Calcutta, Aug. 16: The Narendra Modi-government has launched two bank deposit schemes for the poor to ensure the availability of adequate funds for its flagship "Jan Suraksha" insurance scheme.

Besides, it has introduced a scheme for a gift cheque to ramp up the insurance scheme. The Centre has asked banks to push the schemes ahead of the festive season.

The Prime Minister's Jan Dhan scheme has led to a rush in the opening of bank accounts, but inadequate money in the accounts meant there was no auto-debit of premium for the insurance schemes.

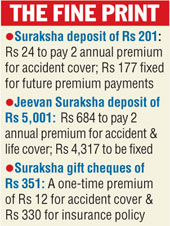

Under the Suraksha deposit scheme, account holders can deposit Rs 201 either in cash or in cheque. Of this, Rs 24 will be used to pay two annual premium of Rs 12 each for the Pradhan Mantri Suraksha Bima Yojana (accident insurance), while the remaining Rs 177 will be fixed for 5-10 years to pay future subscriptions.

A person can also get a banker's cheque to gift a subscription to the policies. The gift cheques worth Rs 351 include a one-time premium of Rs 12 for accident cover, Rs 330 under the Pradhan Mantri Jeevan Jyoti Bima Yojana and Rs 9 as the bank's service charge.

The deposit amount for the Jeevan Suraksha scheme is Rs 5,001, of which Rs 684 will be used to pay two annual premium of the life and accident covers. The rest Rs 4,317, fixed for 5-10 years, will be used to pay the future premium.

The move will assure future premium payments as well address auto-debit concerns in case of zero-balance accounts, an official of a city-based PSU bank told The Telegraph.

"With fixed deposits, future premium payments are assured. This will also address concerns over auto debit in the case of zero-balance accounts," an official of a city-based PSU bank told The Telegraph.

As of August 14, the total enrollment under PMJJBY and PMSBY were 2.75 crore and 8.12 crore respectively. A total of 17.57 crore bank accounts have been opened under Pradhan Mantri Jan Dhan Yojana as of August 12 and 45.76 per cent of these are zero balance accounts.

"These schemes and gift cheques are introduced just before the festive season with the centre sensing an opportunity to increase the enrollment under the Jan Suraksha schemes," said another bank official.

Industry sources said that there is pressure from the centre on the banks and insurance companies of prioritizing outreach drives and camps for these schemes over their existing business with the government extending the last date of enrollment for the two insurance schemes till September 30.

Bank officials said, the move would address the twin challenge of zero balance in accounts and auto debit of premium under the life and accident insurance policies.