The State Bank of India (SBI) will sell a four per cent stake in its subsidiary — SBI General Insurance Company Ltd — for Rs 482 crore ($66 million) in a transaction that will value the latter at over Rs 12,000 crore.

The partial stake sale was approved by the board of the country’s largest bank on Wednesday.

The SBI will sell 86.2 lakh shares to Axis New Opportunities AIF (alternative investment fund) – I, represented through its investment manager Axis AMC Ltd, which will purchase 1.65 per cent.

Similarly, PI Opportunities Fund-I, an AIF of Premji Invest, will acquire 2.35 per cent from the SBI.

The PSU bank said it will hold 70 per cent in SBI GI after the transaction, while its joint venture partner IAG International Pty Ltd will continue to hold 26 per cent.

IAG has a presence in Australia, New Zealand and Asia with a market cap of around $13 billion.

“The SBI welcomes Axis New Opportunities AIF and Premji Invest as our incoming partners in SBI GI. The insurance segment is still young and nascent in India, it is a highly under-penetrated market and we foresee a significant scope of growth for SBI GI to achieve size, scale and profitability. We shall continue to extend our support and are excited about SBI GI’s bright journey ahead,” SBI chairman Rajnish Kumar said.

The Telegraph

SBI GI is one the fastest growing large private insurer with a gross direct written premium of Rs 3,500 crore. It is the seventh-largest private general insurance company as on June 30. It has wide offerings with a balanced product mix and multi-channel distribution that includes bancassurance, direct, brokerage and agency.

The company achieved overall breakeven in 2016-17, within six years of operations.

“SBI GI follows a robust multi-channel distribution model encompassing auto manufacturers, brokers, agencies and has been the top bancassurance non-life insurer in the country. It is present in every district through its own branches, branches of the SBI and RRBs with access to more than 29,500 branches”, Pushan Mahapatra, MD & CEO of SBI General Insurance, said.

Kotak Mahindra Capital was the financial adviser for the transaction and J. Sagar Associates, the legal adviser.

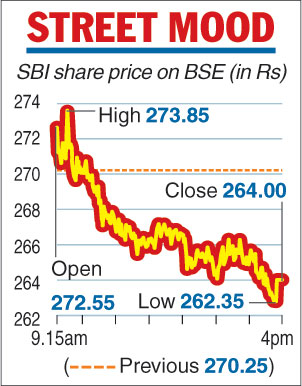

The announcement, however, failed to enthuse the markets. On the BSE, the SBI scrip ended lower by 2.31 per cent at Rs 264.