New Delhi, Jan 24: The Centre today tried to clear the confusion over the litmus test to determine the tax residency of a corporate entity that has business interests in India and overseas by coming out with the guidelines that underlie the concept of Place of Effective Management (POEM).

POEM, which is effective from accounting year 2016-17, is a concept that was introduced through the Finance Act 2015 which laid down two situations under which a company will be considered to be a resident Indian company for tax purposes: first, if it is incorporated in India and, second, if its place of effective management, in that year, is in India.

It added that the place of effective management would be construed to be the country where key management and commercial decisions necessary for conduct of business of an entity as a whole were, in substance, made.

The broad principle had set corporate dovecotes aflutter since it raised the prospect where overseas entities, especially multinational companies, could be treated as a "resultant resident company" that would become liable to tax in India on its global income and not just Indian sourced income.

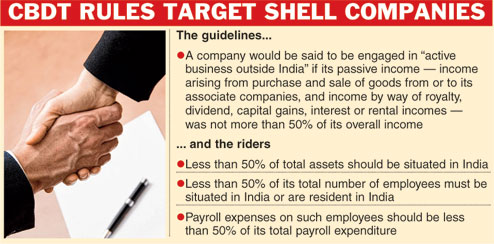

On Tuesday, the Central Board of Direct Taxes (CBDT) came out with the eagerly awaited guidelines to clear the air by stating that a company would be said to be engaged in "active business outside India" if its passive income - that is, income arising from purchase and sale of goods from or to its associate companies, and income by way of royalty, dividend, capital gains, interest or rental incomes - was not more than 50 per cent of its overall income.

In effect, such companies will not be considered to be resident Indian companies for tax purposes.

But the CBDT guidelines tagged on three other riders to the broad rule that the company would need to fulfil in order to qualify for non-resident tax status: (a) less than 50 per cent of its total assets should be situated in India, (b) less than 50 per cent of its total number of employees must be situated in India or are resident in India, and (c) the payroll expenses on such employees should be less than 50 per cent of its total payroll expenditure.

The POEM guidelines shall not apply to companies with a turnover or gross receipts of Rs 50 crore or less in a financial year.

The guidelines also contain illustrations to clarify the situations whether POEM shall or shall not apply.

For the purpose of determining whether the company is engaged in active business outside India, the average of the data of the previous year and two years prior to that shall be taken into account.

The guidelines also went on to define the expressions like income, value of assets, the number of employees, and pay roll.

Income has been defined as the sum computed for tax purpose in accordance with the laws of the country of incorporation, or according to books of accounts where the laws of the country do not require such a computation.

The value of assets in the case of an individually depreciable asset shall be the average of its value for tax purposes in the country of incorporation of the company at the beginning and the end of the previous year.

In the case of a pool of fixed assets which is treated as a block for depreciation, it shall be the average of its value for tax purposes in the country of incorporation of the company at the beginning and at end of the year. And in the case of any other asset, it shall be its value according to the books of account.

The number of employees shall be the average of the number of employees as at the beginning and at the end of the year. But this pool will also include persons, who though not employed directly by the company, perform tasks similar to those performed by the employees. This is designed to stop entities from masking the true number of employees by farming them out to associate and seemingly unrelated entities.

The guidelines said: "The term 'pay roll' shall include the cost of salaries, wages, bonus and all other employee compensation, including related pension and social costs borne by the employer."

"The intent is not to target Indian multinationals that are engaged in business activity outside India. The intent is to target shell companies and companies which are created for retaining income outside India although real control and management of affairs is located in India,"

"It is emphasised that these guidelines are not intended to cover foreign companies or to tax their global income, merely on the ground of the presence of Permanent Establishment or Business connection in India," the government said in a press note.

POEM had become a big worry for global giants that often tend to hold their board meetings in different geographies to give their directors a feel of the terrain in which they operate. The fear was that if Google or Amazon held their board meetings in India - and important decisions were taken on Indian soil - then the company would be treated as a resident Indian company for tax purposes during that year when the board meeting was held here.

"It may be mentioned that mere formal holding of board meetings at a place would by itself not be conclusive for determination of POEM being located at that place. If the key decisions by the directors are in fact being taken in a place other than the place where the formal meetings are held then such other place would be relevant for POEM," the guidelines said.

"The guideline strikes the right balance between providing certainty to taxpayers as well as ensuring that offshore companies with no substance or activities, which are controlled from India, are subject to Indian tax jurisdiction," said Rajendra Nayak, tax partner at EY India.

Rakesh Nangia, managing partner of Nangia & Co, said: "The government has closed the tax avoidance opportunities for companies who sought to artificially escape the residential status by shifting insignificant or isolated events related with control and management outside India."

"The CBDT has provided adequate safeguards to ensure that POEM guidelines do not become an oppressive tool in the hands of revenue to harass genuine assessees. Now the assessing officer can ascertain the residential status of foreign company on the basis of POEM guidelines only after taking a two-stage approval. First approval is required before initiating any proceedings and second approval is required before giving any final finding on residential status of foreign company," Rakesh Bhargava, director of consultancy firm Taxmann, said.