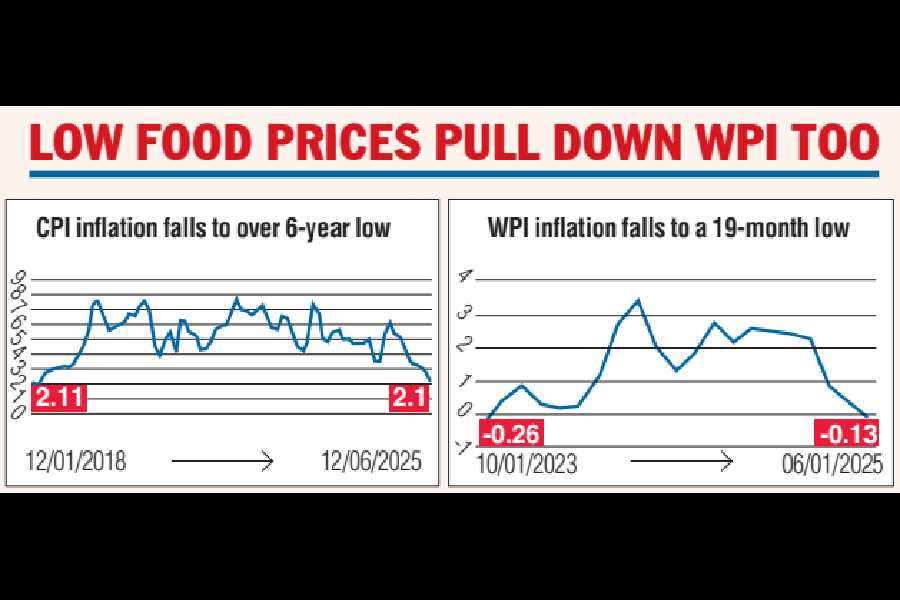

Retail inflation slipped to a more than six-year low of 2.1 per cent in June due to subdued prices of food items, including vegetables, pulses, meat and milk. The consumer price index-based inflation was 2.82 per cent in May and 5.08 per cent in June 2024.

“There is a decline of 72 basis points in headline inflation of June 2025 in comparison with May 2025. It is the lowest year-on-year inflation after January 2019,” the National Statistics Office said in a statement.

The previous low of 1.97 per cent was recorded in January 2019.

Food inflation was –1.06 per cent in June, down from 0.99 per cent in May and 9.36 per cent in June 2024. It is lowest after January 2019.

“The significant decline in headline and food inflation during the month is mainly attributed to a favourable base effect and a drop in inflation of vegetables, pulses, meat and fish, cereals, sugar and confectionery, milk and spices,” the statement said.

“Looking ahead, food inflation is likely to remain contained, supported by healthy agricultural activity and a favourable base. Good progress of monsoon, adequate reservoir levels and strong kharif sowing bode well for agricultural output and food price stability. Close monitoring of the monsoon’s spatial and temporal distribution will remain crucial,” said Rajani Sinha, chief economist, CareEdge Ratings.

“While global commodity prices are expected to remain benign, we cannot rule out intermittent spikes amidst geopolitical conflicts,” said Sinha.

Opinions split

Economists are split in their opinion on whether the downward trajectory of inflation leaves room for a further rate cut from the RBI. “With food inflation remaining muted and demand-side pressure on inflation contained, we expect average CPI inflation of 3.5 per cent for FY26. The RBI has already front-loaded the rate cuts anticipating moderation in inflation, hence we do not expect further rate cuts, unless economic growth weakens materially,” said Sinha.

“We expect headline inflation to average 4 per cent this fiscal, from 4.6 per cent last fiscal. Lower inflation gives the RBI’s Monetary Policy Committee the headroom for one more repo rate cut this fiscal, apart from the cumulative cut of 100 basis points so far,” said Dipti Deshpande, principal economist, Crisil Limited.

“We expect the FY26 inflation to undershoot RBI’s estimates of 3.7 per cent by around 50 basis points. While comfortable inflation opens room for further monetary easing, we expect the RBI to maintain a pause in the coming 1-2 meetings and remain watchful of the transmission ahead along with global uncertainties,” said Upasna Bhardwaj, chief economist, Kotak Mahindra Bank.

WPI negative

Wholesale price inflation (WPI) turned negative after a gap of 19 months at -0.13 per cent in June as deflation widened in food articles and fuel, along with softening in manufactured product costs, government data showed on Monday. WPI-based inflation was 0.39 per cent in May. It was 3.43 per cent in June last year.

“Negative rate of inflation in June is primarily due to a decrease in prices of food articles, mineral oils, manufacture of basic metals, crude petroleum & natural gas etc,” the industry ministry said.