The insurance regulator is working on guidelines to lower the minimum paid-up capital criterion so that smaller insurance companies can come up with dedicated products.

Under the current guidelines set by the Insurance Regulatory and Development Authority (Irda), the minimum paid-up capital requirement for life or general insurance companies, including standalone health insurers, is Rs 100 crore. This is applicable for all irrespective of product portfolio or geographic presence.

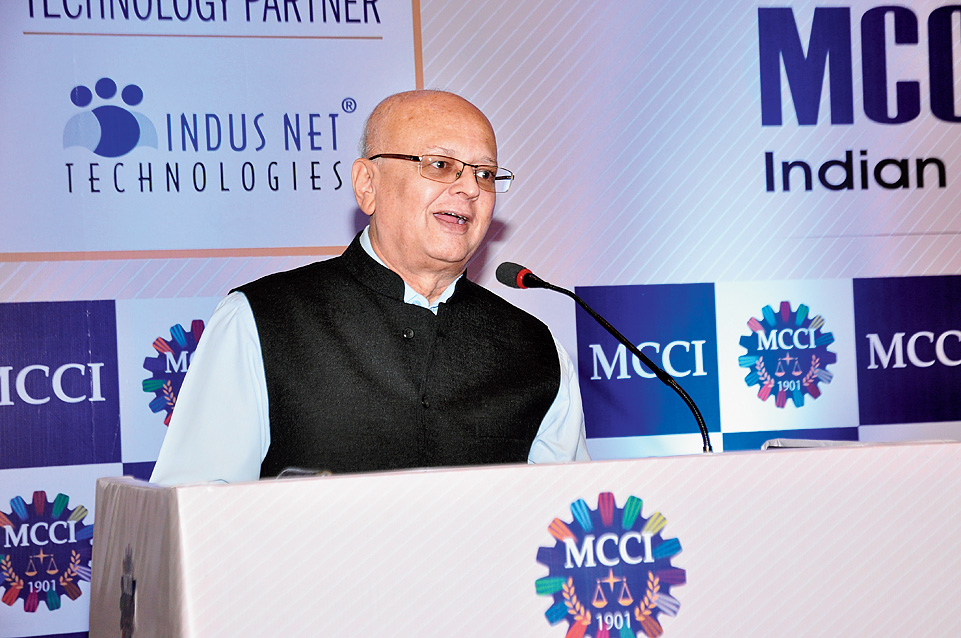

“Right now, the risk-based structure is such that we have a minimum requirement of capital and it is Rs 100 crore to start with,” said Nilesh Sathe, member (life), Irda.

“The idea is more risky businesses require more capital. But when the capital requirement is less, more insurance companies will start the business,” he said on Thursday at a session organised by the Merchants’ Chamber of Commerce and Industry.

As an example, Sathe said, an insurer may want to sell a particular product or do business in a particular geography for which his capital requirement is lower compared with other companies who want to have a diversified insurance portfolio or a wider geographic presence.

There are 24 life insurance companies and 34 general insurance companies (including standalone health insurance companies).

Like the Basel requirement of capital for banks, Sathe said globally there is an International Association of Insurance Supervisors, which develops core principles and the upcoming guidelines are expected to be in line with the global practices.

Revival norms

The regulator is also working on a set of product tweaks aimed at making insurance more user friendly. A key change will be the time limit on reviving lapsed policies.

“Earlier, we never allowed a policy to be revived after two years. If the policyholder has not paid premium and the policy has lapsed and after three years the person wants to revive the policy by paying the balance, it is not allowed. We are thinking about extending this to five years,” said Sathe.