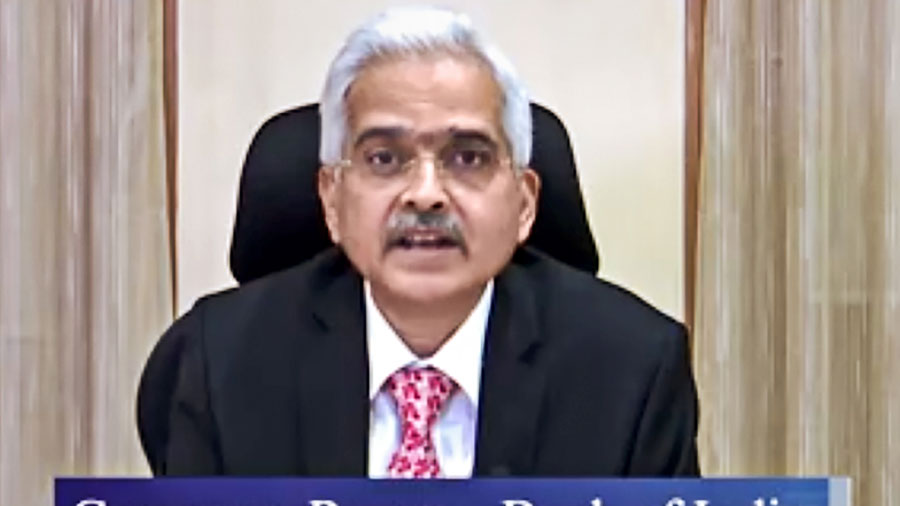

Reserve Bank of India (RBI) governor Shaktikanta Das has debunked criticism emanating from certain quarters that the central bank has fallen behind the curve in its fight against retail inflation which has stubbornly stayed above 6 per cent for five straight months.

The RBI has a mandate to keep retail inflation within a 2 to 6 per cent limit but has failed to do so.

In April, inflation measured by the consumer price index (CPI) leapt to an eight-year high of 7.79 per cent before dipping slightly to 7.04 per cent in May.

The RBI has raised the policy repo rate twice in the past five weeks by 90 basis points to 4.90 per cent with some pundits suggesting that it could rise to as high as 6.50 per cent next year.

“If we had been firm in maintaining inflation at 4 per cent (the preferred mid-point of the tolerance band) and kept rates unduly high, I’m sorry, the consequences of that approach would have been disastrous for the economy…it would have taken years for India to come back,” governor Das said at a banking conference in Mumbai.

Critics have felt that the RBI refused to raise rates when the central banks in the advanced economies led by the US Federal Reserve had turned hawkish and had started aggressively raising policy interest rates. They contend that the Fed has already raised the interest rate by 125 basis points and will raise it by another 50 basis points before the RBI’s policy makers hunker down again for their next meeting in early August.

Some economists have felt that the RBI should have launched its assault on inflation as early as February this year. It was only in April that the MPC members voted to remain accommodative but signalled that they would gradually start to wind down the surplus liquidity in the system.

The decision to tighten monetary policy - a key change in stance after embracing an easy money policy in June 2019 - would be done in a smooth manner to ensure that there would be a “soft landing”. The monetary spigot has been tightened to drain over Rs 6 lakh crore of liquidity in the system, Das said.

Das said the RBI would soon issue suitable guidelines and measures to make the digital lending ecosystem safe and sound while enhancing customer protection and encouraging innovation.

He, however, raised concerns over the implications of large tech companies or the BigTech (like Google, Amazon or Meta) entering into providing financial services.

While this could potentially be another source of disruption to the financial system, the RBI Governor said that these companies have an enormous amount of customer data which has helped them to offer tailored financial services to entities and individuals lacking credit history or collateral.