Mumbai: The Reserve Bank has kept its interest rates unchanged for the third time in a row with a note that a higher government spending would accelerate inflation, while warning of risks from a wider fiscal deficit.

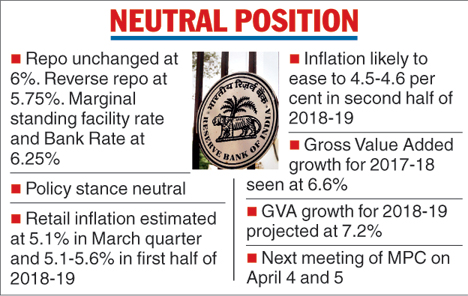

The six-member Monetary Policy Committee (MPC), headed by RBI governor Urjit Patel, retained the repo rate at 6 per cent and the reverse repo at 5.75 per cent.

The RBI kept a neutral stance at its sixth and last bi-monthly monetary policy review of 2017-18, much to the relief of market players.

Inflation, which surged to a 17-month high of 5.21 per cent in December, is likely to accelerate further after the budget for 2018-19 widened the fiscal deficit target so as to finance higher rural spend and a mega healthcare plan.

On higher minimum support price for farm produce, the RBI sought some more time to assess its impact on prices.

"We are still awaiting some specifics on that in terms of costing it... we have said that there could be an impact but we have not said how much," Patel said. "There is not enough information about what the costing would be."

The Union Budget 2018-19 would stoke demand but worsening public finances may crowd out private funding and investment, the RBI said.

On the deficit target, Patel warned that any major deviation would make meeting inflation targets challenging.

The RBI upped its inflation forecast to 5.1 per cent for the fourth quarter of 2017-18, which ends on March 31. It expects inflation to firm up further to 5.1-5.6 per cent in the first half of the next fiscal, before cooling down to 4.5-4.6 per cent in the second half.

There is "need for vigilance around the evolving inflation scenario in the coming months", the RBI said. "Fiscal slippage as indicated in the Union budget could impinge on the inflation outlook."

Upside risks to inflation include oil prices and the impact of the implementation of the HRA by various states.

Patel and four other MPC members voted for status quo on the interest rate, while Michael Patra favoured a 25-basis-point rate hike.

Stating that it stays committed to keeping headline inflation close to 4 per cent, the RBI put the gross value added - a key measure of growth - at 7.2 per cent for the next fiscal with risks evenly balanced.

For the current fiscal, it lowered the GVA growth rate to 6.6 per cent from the previously projected 6.7 per cent. This compares to the 6.5 per cent forecast by the government, down from 7.1 per cent a year earlier.

The MPC feels the "nascent economic recovery needs to be carefully nurtured and growth put on a sustainably higher path through conducive and stable macro-financial management".

"The monetary policy was far less hawkish than expectations, implying that unless things go really awry and push inflation way above the projected trajectory, the RBI could stay on hold," Abheek Barua of HDFC Bank said.