New Delhi, March 31: For the first time in over three decades, public provident fund (PPF) deposits will earn less than 8 per cent interest from tomorrow. The last time the PPF rate was below 8 per cent (at 7.9 per cent) was in 1979-80.

A finance ministry notification said investments in PPF will fetch annual returns of 7.9 per cent for the April-June quarter against the existing interest rate of 8 per cent.

A five-year fixed deposit with the SBI earns an interest of 6.5 per cent at present. As of August 2016, PPF had an outstanding of Rs 56,648 crore.

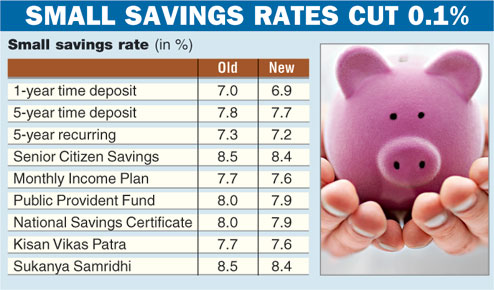

The revision is part of the government's move to lower interest rates on small saving schemes such as PPF, Kisan Vikas Patra and Sukanya Samriddhi Scheme by 0.1 per cent for the April-June quarter.

Since April last year, interest rates of all small saving schemes are being calibrated on a quarterly basis to align with other rates in the economy.

The move could spur banks, which have already cut deposit rates, to reduce rates further given the liquidity available in the banking system and lack of credit demand.

According to RBI statistics, banks' credit growth at 4.1 per cent at the end of March 3 has hit its lowest in the decade. The banking system is also sitting on a surplus of about Rs 4.68 lakh crore on an average this month, according to data compiled by Edelweiss Financial Services.

The cut will have a marginal impact on investors who depend on interest income from small savings schemes. For example, if you invested Rs 1 lakh, you would have earlier got an interest of Rs 8,000 per annum at 8 per cent. Now you will get Rs 7,900 per annum at 7.9 per cent.

Investments in five-year National Savings Certificate will fetch 7.9 per cent interest, down from 8 per cent. Kisan Vikas Patra (KVP) will yield 7.6 per cent and mature in 113 months.

The Sukanya Samriddhi Account Scheme will offer 8.4 per cent annually from 8.5 per cent at present, while the five-year Senior Citizens Savings Scheme will offer a similar rate of 8.4 per cent. The interest rate on the senior citizens scheme is paid quarterly.

Term deposits of 1-5 years will fetch a lower 6.9-7.7 per cent, payable quarterly, while the five-year recurring deposit has been pegged lower at 7.2 per cent.

The finance ministry said: "The current revision of rates is reflective of the government's commitment to calibrated reform in the financial sector to ensure better interest rate transmission."

"Various small savings schemes will continue to be very attractive compared with bank deposits of similar maturities and tenor even after this marginal reduction in interest rates by 0.1 percentage points. Apart from offering higher interest rates compared with bank deposits, some of the small savings schemes also enjoy income tax benefits," it said.

The ministry had earlier said that the rates of small saving schemes would be linked to government bond yields.