Mumbai, Feb. 1: Markets went cock-a-hoop over the budget with a 486-point sensex salute, shrugging off a minor disappointment on corporate tax rates and focusing on gains for some other classes of investors and sectors.

Although a widely expected cut in the tax rate for large firms did not materialise, investors were cheered by finance minister Arun Jaitley's decision to leave the capital gains tax system on shares unchanged and exempt certain classes of foreign portfolio investors from taxation on indirect cash transfers.

Sentiments were also boosted by the finance minister setting a fiscal deficit target of 3.2 per cent of the gross domestic product (GDP) for 2017-18, suggesting the Centre was determined to shore up its finances.

Real estate, clobbered by demonetisation, was a toast of the market today after the government announced infrastructure status for affordable housing and offered a salad of other sops.

Banking shares finished with handsome gains, fired up by the announcement that the government would shovel more money into state-run banks at a time they have been hobbled by mounting bad loans.

Investor wealth - as measured by the market capitalisation, or the value of all shares traded on an exchange - on the BSE soared by a staggering Rs 1,71,442 crore. The strong close came at a time of fears over the policies of the Donald Trump administration in the US, especially the new visa regime that could affect the bottomlines of Indian IT firms.

Ahead of the budget, investors had been skittish about the possibility of a long-term capital gains (LTCG) tax on shares. Currently, investors selling shares after holding them for over a year do not have to pay any tax. If sold within a year, a capital gains tax of 15 per cent must be paid. There were apprehensions that the finance minister could raise the holding period to at least two years or bring in a tax on long-term capital gains.

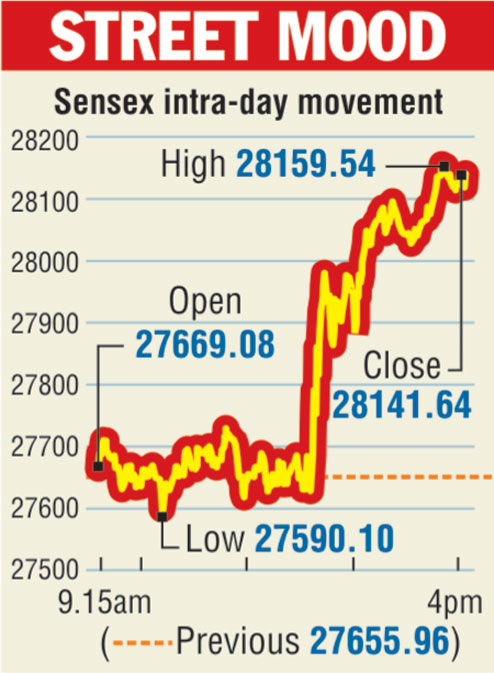

The 30-share sensex opened steady at 27669.08 but went up steeply after the completion of Jaitley's speech as the market digested the budget fine print. The index touched an intra-day high of 28159.54 before cooling to settle at 28,141.64. That showed a surge of 485.68 points or 1.76 per cent over the previous close. It was also the highest closing since October 24 when the index had ended at 28,179.08. The NSE nifty rallied by 155.10 points to settle at 8,716.40.

"No change in the long-term capital gains tax (system) on equities has calmed investors' fears (about a rise in) transaction costs. The budget has given a positive momentum to the market. The focus was to reduce the fiscal deficit to 3.2 per cent of the GDP in 2017-18," Vinod Nair, head of research at Geojit BNP Paribas Financial Services, said.