New Delhi, April 20: Once a terror for Indian family-owned businesses he targeted as a young corporate raider, Lord Swraj Paul, now 73, feels it's not worth his time to try taking over an Indian company through a hostile bid.

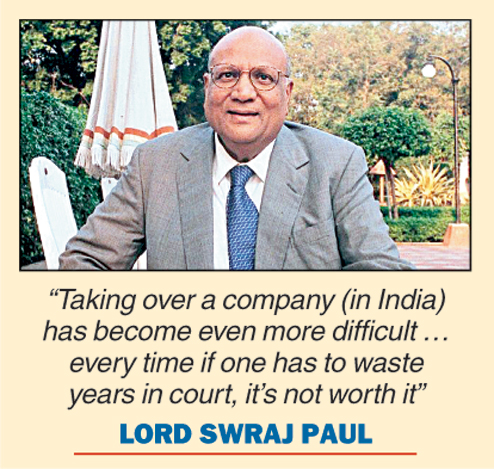

"Taking over a company (in India) has become even more difficult ... every time if one has to waste years in court, it's not worth it (a take-over bid)," said Lord Paul, head of Caparo Group, in an interview with The Telegraph.

In 1982, Lord Paul had launched well-publicised stock market raids on two of India's leading firms - DCM and Escorts - much to the dismay of Indian tycoons.

The Bharat Ram family owned about 10 per cent of the DCM stock at that time, while the Nanda family had a 5 per cent share in Escorts, giving Paul a chance to take over the board by simply buying more shares than the original promoters.

"I ended up buying 7.5 per cent of Escorts and 13 per cent of DCM, so I held more shares than them ... but local businessmen felt threatened and tried to block me," said Lord Paul.

Despite this relatively small promoter holding, support by public financial institutions and delays in Indian courts gave the promoters the much-needed time to ramp up their holdings.

Both firms refused to register his share purchase for years and the case went up to the Supreme Court, which eventually upheld his right to hold those shares and have them registered.

By then, Lord Paul had decided that it was not worth his time to take over the two textile and automobile giants and decided to sell the shares at a profit.

"It was the late Indira Gandhi (then Prime Minister) and Pranab Mukherjee (then finance minister), now India's President, who were forward looking enough to open up the economy and allow NRIs to invest here," he said.

"But since then we wasted 30 years because of the smallness of Indian (business). It is only now after a lapse of 35 years, that we have a Prime Minister who has made us NRIs feel welcomed by recognising us."

However, the 1980s hostile takeover bid by Paul along with another successful hostile takeover by the Gulf-based Chabrias of Calcutta-based Shaw Wallace made India Inc wake up to the possibility of their cocooned lives being shattered by 'foreign capital'.

The liberalisation ushered in by Prime Minister Narasimha Rao and his finance minister Manmohan Singh in the 1990s opened up Indian business to even more competition from global firms, which started investing here, forcing formation of protectionist lobbies such as the 'Bombay Club' of business houses which sought some form of continued tariff and investment protection.

"Do you know that one leader at that time said if we allow NRIs in, India will be opened up to the whirlpool of world finances?" Paul chuckled.

Paul said he has again re-focussed attention on India but with plans for organic growth by investing in new businesses.

"I have posted my grandson and my grand-daughter here to see what we can do in India."

The group, which is involved in forging, automobile parts and hospitality, is looking at new areas such as producing bio-digestor toilets developed by DRDO, electric rickshaws, solar power and low cost housing solutions, said sources.