New Delhi, March 2: The finance ministry and the Reserve Bank of India have finally signed an agreement that anchors the monetary policy to a clearly defined inflation target.

The agreement formalises a loosely configured arrangement that the RBI has followed since Raghuram Rajan took over as the central bank governor in September 2013.

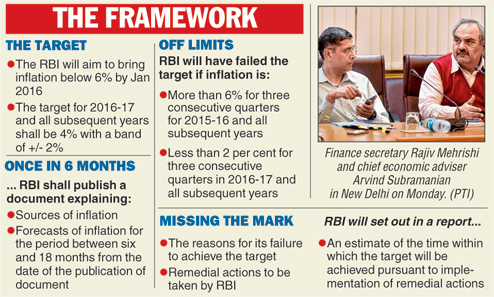

The agreement signed on February 20 - eight days before finance minister Arun Jaitley presented the budget - sets a retail inflation target of 6 per cent by January 2016.

The inflation target for 2016-17 and all subsequent years will be 4 per cent with a band of plus or minus 2 per cent.

These targets had been suggested by RBI deputy governor Urjit Patel in a report submitted in January last year - and the RBI has been fine-tuning its monetary policy on the basis of that glide path.

The difference now is that for the first time, the RBI will be held accountable if it fails to peg inflation to the desired target.

The RBI will be deemed to have failed to meet the target if retail inflation hovers above 6 per cent for three consecutive quarters of 2015-16.

It will also be required to come up with an explanation if inflation tumbles below 2 per cent in any three consecutive quarters from 2016-17 onwards.

The central bank will have to put out a report every six months identifying the sources of inflation and giving its forecasts for a period between six and 18 months from the date on which the document is published.

Retail inflation is currently pegged at 5.11 per cent and many believe that the stage is now set for another rate cut. The RBI cut the policy rate - the repo - by 25 basis points to 7.75 per cent. The central bank is due to review its monetary policy on April 7.

If the RBI fails to meet the target, it will have to submit a report to the government setting out the reasons why it missed the target. It will also have to propose remedial actions and give a time period by when it will be able to bring inflation within the desired band.

"The monetary policy framework is clear: the objective is to contain inflation," finance secretary Rajiv Mehrishi said.

Several central banks around the world use inflation targeting to determine the conduct of monetary policy.

The central bank usually relies on short-term instruments such as interest rate changes to influence the course of inflation.

"This framework will decrease the uncertainty around the decision-making process and there will be limited possibility of any speculation," said Rupa Rege Nitsure, group chief economist at L&T Financial Services.

Mehrishi said the government would introduce amendments to the RBI Act to allow for the creation of a monetary policy committee (MPC). A decision would be taken in the next financial year after consultations with the RBI and other stakeholders.

The suggestion for an MPC was first articulated by the YV Reddy committee on international standards and codes in 2002. It was reiterated by the Tarapore committee on fuller capital account convertibility in 2006 and the financial sector legislative reforms commission (FSLRC) headed by Justice Srikrishna which submitted its report in March 2013.

The agreement between the Centre and the RBI is broadly based on the suggestions made by the FSLRC report.

The FSLRC had said that a seven-member committee should be formed to decide on the conduct of monetary policy. At present, the RBI governor has the sole authority to make the call on interest rate cuts after consultations with a range of experts.

Both the FSLRC and the Urjit Patel reports have embraced the idea of having a monetary policy committee but differ on its composition and the manner of appointments. The FSLRC had suggested that two of the seven members of the committee should come from the RBI including the governor.

The other five should be external members. Two of these external members should be appointed in consultation with the RBI governor. The other three should be appointed by the Centre. It also suggested that a representative of the Centre should participate in the discussions but would not have a vote.

The Urjit Patel committee had said the MPC should have five members: the RBI governor, and the deputy governor as well as the executive director in charge of monetary policy. There should be two external members to be decided by the governor and the deputy governor.

It is not known at this stage which formula the Centre will accept for the composition of the MPC.