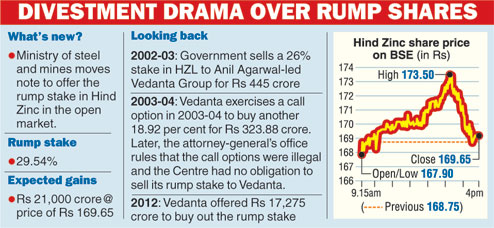

New Delhi, June 5: The ministry of steel and mines has moved a note to offer the government's residual stake in Hindustan Zinc in the open market.

The note is in line with the advice of the attorney general's office on divestment of the rump shares held by the government in the zinc miner and refiner.

"Hindustan Zinc has ceased to be a government company for almost a decade. One way could be to sell the shares in the open market if the prevailing market (price) is considered to be fair," former attorney-general G.E. Vahanvati had earlier told the mines ministry.

The government owns a 29.54 per cent stake in HZL. Based on today's closing price of Rs 169.75, the government could earn nearly Rs 21,000 crore from the sale.

The NDA government under Prime Minister Atal Behari Vajpayee had sold a 26 per cent stake in HZL in 2002-03 to Anil Agarwal-led Vedanta Group and earned Rs 445 crore. A year later, it accepted a call option by Vedanta to sell another 18.92 per cent for Rs 323.88 crore.

Later, the AG's office had ruled that the put and call options were illegal according to the existing laws for companies and said the government was not under any obligation to sell its residual stake to Vedanta.

India's company law now allows put and call options. But since the sale agreement was signed more than a decade ago, when the law did not allow these, officials said they felt the best option was to go in for an open market sale of the residual shares.

While the call option is an agreement that gives an investor the right to buy a stock, bond, commodity, or other instrument at a specified price within a specific time period, a put option is the right of a seller to do the same.

In January 2012, Vedanta, which holds the shares bought by Sterlite, had offered Rs 17,275 crore to buy out the remaining stake of the government in Hindustan Zinc and Balco, reigniting the government's interest in ordering a rump stake sale.

However, the tricky problem for the BJP-led government with the residual sale is that it has to maintain a greater degree of transparency as the earlier strategic sales of Balco and HZL during the last NDA regime had attracted a lot of flak inside and outside Parliament.

The government had sold a strategic 51 per cent stake in Balco to the same Vedanta group in a controversial deal for some Rs 551 crore in 2001. The deal was challenged in Parliament by the Congress party as well as by the Left, with parliamentarian Kapil Sibal claiming that it could have fetched Rs 3,000 crore or more.

The government has budgeted Rs 69,500 crore from PSU stake sales, including Rs 28,500 crore through strategic sales in companies that were privatised earlier, including Balco and Hindustan Zinc.

In May, the government approved the sale of shares in state-run oil refiner Indian Oil Corp and power producer NTPC. New Delhi will sell a 10 per cent stake in the oil refiner and 5 per cent in the power producer.

The planned share sales could fetch $2.17 billion at current market prices. The proceeds from the asset sale programme are critical for finance minister Arun Jaitley's plan to narrow the fiscal deficit to 3.9 per cent of the gross domestic product in 2015-16.

So far, the government has only raised about $250 million (Rs 1,550 crore), after offloading a 5 per cent stake in Rural Electrification Corp in April.