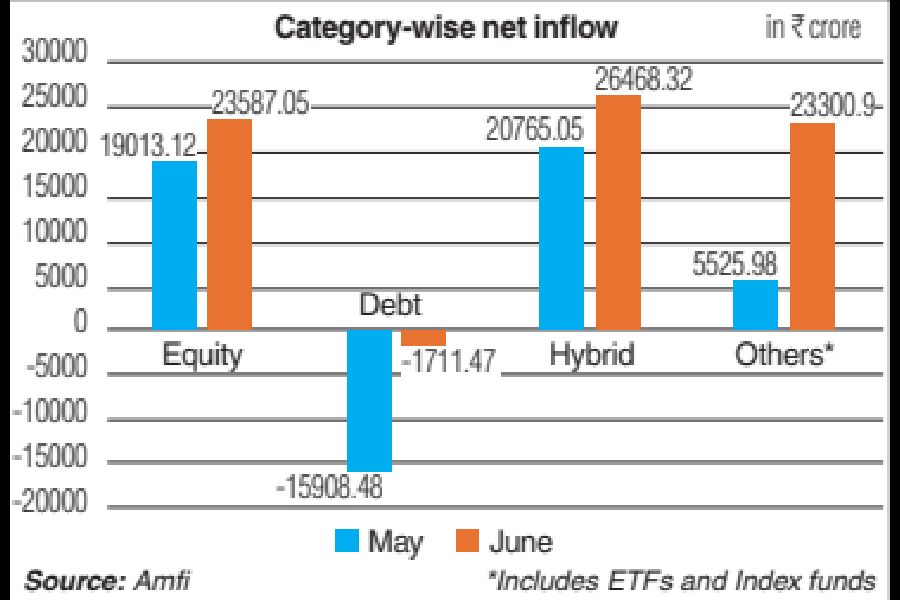

Inflows into equity mutual funds grew 24 per cent to ₹23,587.05 crore in June from ₹19,013.12 crore in May, driven by strong inflows into flexi cap, small cap and mid cap funds. A recovery in inflows is seen after five consecutive months of decline in the segment.

Data released by Amfi on Wednesday shows investors have flocked to flexi cap funds that offer fund managers the flexibility to invest across all market capitalisation segments. Inflows into these funds during June was ₹5,733.16 crore, the highest among the contributors to the equity fund inflows during the month, and ahead of small cap funds (₹4,024.50 crore) and mid cap funds (₹3,754.42 crore).

The assets under management in flexi-cap funds reached ₹4,82,665.23 crore in June, the second-highest in the equity category after sectoral/thematic funds, with assets of ₹4,99,575.10 crore.

The hybrid schemes saw an inflow of ₹23,222 crore, driven primarily by ₹15,584.57 crore in inflows into arbitrage funds in June. These funds aim to generate returns by exploiting price differences of the same asset in different markets, typically the cash and futures markets.

“Flexi cap category has seen strong traction in June and is fast becoming the largest equity category, also by assets under management. Gold ETFs saw an inflow of nearly ₹2,000 crore, suggesting investor interest to seek both diversification and also gain from the performance of the precious metals,” said Anand Vardarajan, chief business officer, Tata Asset Management.

“While market volatility has made some investors cautious, we are also witnessing a healthy shift towards hybrid and arbitrage funds, a trend that shows maturing investor behaviour and a preference for balanced risk strategies in uncertain times,” said Venkat N Chalasani, chief executive, Amfi.

“With global rate cycles stabilising and India’s earnings season underway, we expect investor focus to remain strong on thematic and multi-asset categories heading into Q2FY26,” said Ankur Punj, MD and national head, Equrius Wealth.

However, debt funds saw an outflow of ₹1,711.47 crore in June as investors realigned their portfolio.

“In the fixed income space, due to corporate investors and quarter-end dynamics, liquid and overnight funds witnessed net outflows of over ₹33,000 crore,” said Gaurav Goyal, national head, sales and marketing, Canara Robeco AMC.

SIPs drive growth

The industry’s assets under management grew from ₹72.19 lakh crore in May to ₹74.41 lakh crore in June. SIP contributions in June stood at ₹27,268.79 crore compared with ₹26,688 crore in May. The number of contributing SIP accounts stood at 8.64 crore in June against 8.56 crore in May.

“Riding on mark-to-market gains from equities, the industry’s AUMs have reached an all-time high in June. As SIPs continue to gain traction and equity markets sustain their upward momentum, the ₹100 lakh crore AUM target appears within reach,” said Viraj Gandhi, CEO, Samco MF.