US President Donald Trump’s reciprocal tariffs on India and the consequent uncertainty may have spooked global investors, with FPIs remaining net sellers so far in 2025, but domestic mutual fund investors, while exercising caution due to market volatility, remained net buyers.

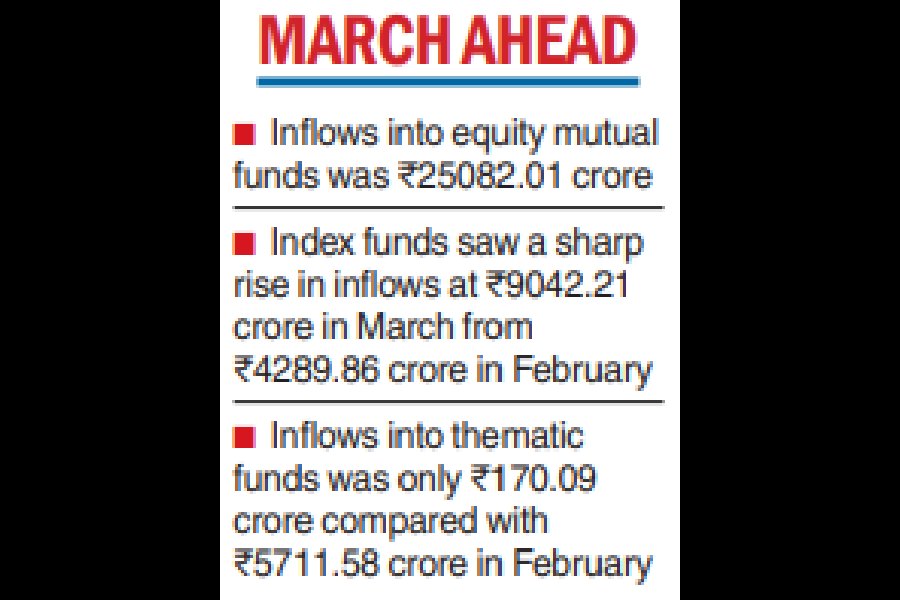

Data published by Amfi on Friday showed inflows into equity mutual funds was ₹25082.01 crore, with investments seen across all equity segments in March.

Even as the inflow was at an 11-month low, reflecting investor cautiousness in a volatile market, it also marks the 49th month of positive inflows, starting from March 2021, which observers said shows investor discipline.

On a sequential basis, inflows into equity funds for March was less by 14 per cent compared to February. But on a year-on-year basis it was up by 11 per cent.

A closer look at the net inflow numbers for March shows a shifting investor preference in favour of low-risk passive investment into index funds and exchange-traded funds. Inflows into index funds saw a sharp rise of ₹9042.21 crore in March from ₹4289.86 crore in February. In contrast, inflows into thematic funds was only ₹170.09 crore compared to ₹5711.58 crore in February.

During March, 30 new funds (NFOs) were launched, which garnered fresh inflows of ₹4085 crore. Of them, 11 were index funds and 10 were ETFs.

“The mutual fund industry has demonstrated resilience and growth, despite market volatility and global policy uncertainties driven by frequent US tariff changes. As of March, we have seen a 31.85 per cent increase in folio count, with Assets Under Management (AUM) reaching ₹65.74 lakh crore, up from ₹53.40 lakh crore in March 2024, representing a 23.11 per cent increase in 2024-25,” said Venkat Chalasani, chief executive, Amfi.

Amfi said that in FY25,the average monthly SIP (systematic investment plan) contribution reached ₹24,113 crores, marking a significant increase from ₹16,602 crores in FY24

The number of new SIPs registered in March 2025 stood at 40,18,564, while the SIP AUM was at ₹13,35,188.07 crores for the month. The number of contributing SIP accounts stood at 8.11 crores.

From the debt mutual funds, there was an outflow of ₹2,02,663.04 crore, which was largely due to redemption pressure on liquid and overnight funds on account of advance tax payments, generally seen at year-end.

Changing dynamics

Mutual funds are increasingly gaining traction as a household financial asset. Data from the RBI shows that the share of mutual funds as a per cent of household financial assets has touched 10.5 per cent in March 2024 compared to 8.5 per cent in March 2022.

Data from Amfi further shows that the share of B30 (beyond 30) cities in AUM has increased from 19 per cent in March 2024 to 27.14 per cent in February 2025.