The Telegraph

A massive outflow from liquid funds and income schemes amid the crisis at IL&FS has led to the asset base of the domestic mutual fund industry taking a knock of 12.5 per cent during September.

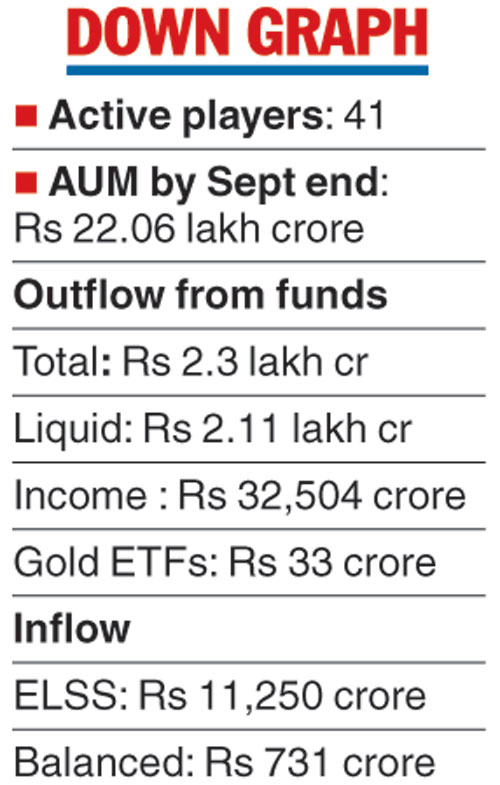

According to data from the Association of Mutual Funds in India (Amfi), the asset under management (AUM) of the sector, comprising 41 players, stood at Rs 22.06 lakh crore at the end of September compared with a record Rs 25.20 lakh crore in August.

The monthly drop in the asset base was mainly because of an an outflow of Rs 2.3 lakh crore. This came on the back of a Rs 2.11 lakh crore withdrawal from liquid funds. In August, these funds had witnessed an inflow of Rs 1.71 lakh crore. For the industry as a whole, the inflow then stood at over Rs 1.74 lakh crore.

Liquid funds invest largely in highly liquid money market instruments and debt securities of very short tenure. These include instruments such as treasury bills (T-bills), commercial papers (CPs) and certificates of deposit (CDs) which have residual maturities of up to 91 days.

Debt schemes have been the focus of attention since the crisis at IL&FS. While the infra lending conglomerate defaulted on various market instruments, the development had its impact on the credit markets with non-banking finance companies (NBFCs) witnessing a liquidity squeeze.

Moreover, mutual funds —estimated to have exposure of more than Rs 2,500 crore to IL&FS — also saw redemptions. The AMFI data also showed that income schemes saw a pullout of Rs 32,504 crore. Besides, gold ETFs continued to see net outflow of Rs 33 crore.

However, there was some good news as equity and equity-linked saving scheme (ELSS) saw an infusion of Rs 11,250 crore. Besides, balanced funds witnessed an inflow of Rs 731 crore. “Despite the market volatility and the credit event which occurred, the flows in the equity segment of the market from retail investors have been positive,” N.S. Venkatesh, chief executive of AMFI, said.

The average AUM for the September quarter showed a growth of 16 per cent over the same period last year.

“There has been a robust growth in the number of folios at a 26 per cent annual growth rate, which now stand at over 7.75 crore.