|

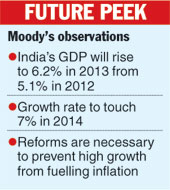

Mumbai, March 7: Moody’s Analytics, an arm of global credit rating agency Moody’s Investors Service, today said the Indian economy would bounce back from the current slowdown and the growth rate would touch 7 per cent in 2014.

It, however, warned that the higher growth without reforms would fuel inflation, resulting in painful adjustments.

In a report, Moody’s said the country’s gross domestic product (GDP) would rise to 6.2 per cent in 2013 from 5.1 per cent in 2012, and thereafter, touch a new growth trend of 7 per cent from 2014.

Elaborating the reasons for the upturn in growth, Moody’s said while the global environment had stabilised in recent times, the government had embarked on a path of fiscal and regulatory reforms. Risks from fiscal and current account deficits have also begun to ebb.

“The biggest change is that the government is now on a steady path of fiscal and regulatory reforms and better governance. The so-called big bang of economic reforms announced since August has helped to lift corporate confidence and should translate into better spending and capital expenditures from mid-2013,” Moody’s said.

On the need for growth with reforms, Moody’s Analytics said a growth rate above 7 per cent could lead to higher inflation and result in a more “painful future adjustment”.

It added that while some policymakers were now seeking a return to double-digit growth, this was highly optimistic and would not be achievable without any significant structural reform.

Moody’s had given a thumbs-up to the budget, saying it offered a realistic plan to cap the fiscal deficit.

The fiscal consolidation plan was “credit positive for the sovereign”, Moody’s added.

Finance minister P. Chidambaram has targeted to bring down the fiscal deficit to 4.8 per cent of GDP from 5.2 per cent in the revised estimates for the current fiscal.

Moody’s observations have raised hopes that the ratings agency will not go for a sovereign downgrade of India. India now has a Baa3 rating, which is the lowest investment grade.