The country’s microfinance sector, which recorded a robust performance in the first quarter, may need Rs 6,000-9,000 crore over the next three years to meet its growth plans, a report has said.

According to credit rating agency Icra, growth prospects for the sector remain good and the industry is expected to grow at 20-22 per cent in the current financial year.

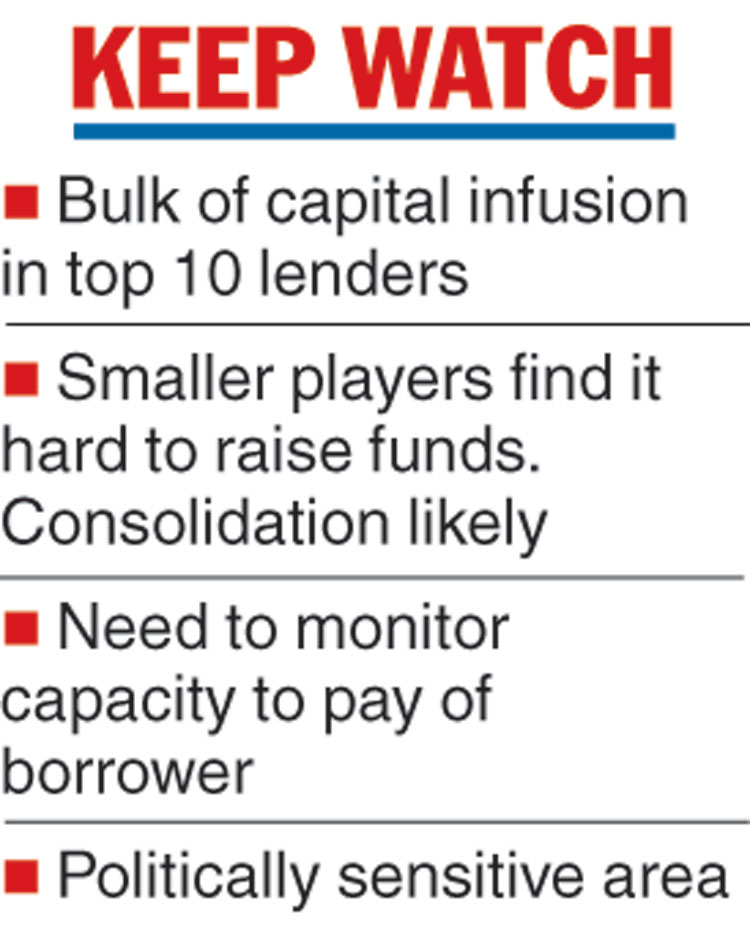

It, however, pointed out that while investors continued to support the industry with equity infusion of Rs 4,061 crore in the previous fiscal, close to 87 per cent of the capital was infused in the top 10 lenders.

“The sector would need external capital of Rs 6,000-9,000 crore till 2020-21 to meet the growth plans,” the report said.

It cautioned that while raising capital is unlikely to be a major impediment for well-managed large microfinance institutions (MFIs) or small finance banks, the smaller entities may continue to struggle to raise equity. This could lead to a consolidation in the industry with smaller MFIs being acquired by larger NBFCs or banks.

The credit rating agency further said that an analysis of the portfolio of MFIs shows that the ticket sizes and loan tenures are rising.

The Telegraph

Though the opportunity to scale up and grow remains intact, there is a need for a more involved credit analysis and assessment of the actual debt repayment capacity of the borrower.

Further, the risk management policies of the lenders in the sector also need to be aligned with responsible and sustainable growth, where the overall indebtedness of the borrower from all formal sources is considered.

“The segment remains vulnerable to income shocks and is politically sensitive. Therefore, Icra expects credit costs for the sector to remain volatile with mean credit costs at 1.5-2.5 per cent, which could vary among players across cycles, depending on their risk management practices,” it warned.

The report pointed out that banks were the most significant providers of microcredit (60 per cent) as on June 30, followed by non-banking finance companies (NBFCs) at 26 per cent and small finance banks at 14 per cent.

Icra expects the share of banks to expand with the expected merger of Bharat Financial Inclusion Ltd and IndusInd Bank and the increased focus of banks on growing their business correspondent portfolios. There is also the trend of banks or larger NBFCs taking stakes in MFIs.