Dalal Street on Monday cheered the Centre's plans for big bang reforms in the goods and services tax by Diwali to boost consumption and support growth amid stalled negotiations on a trade deal with the US.

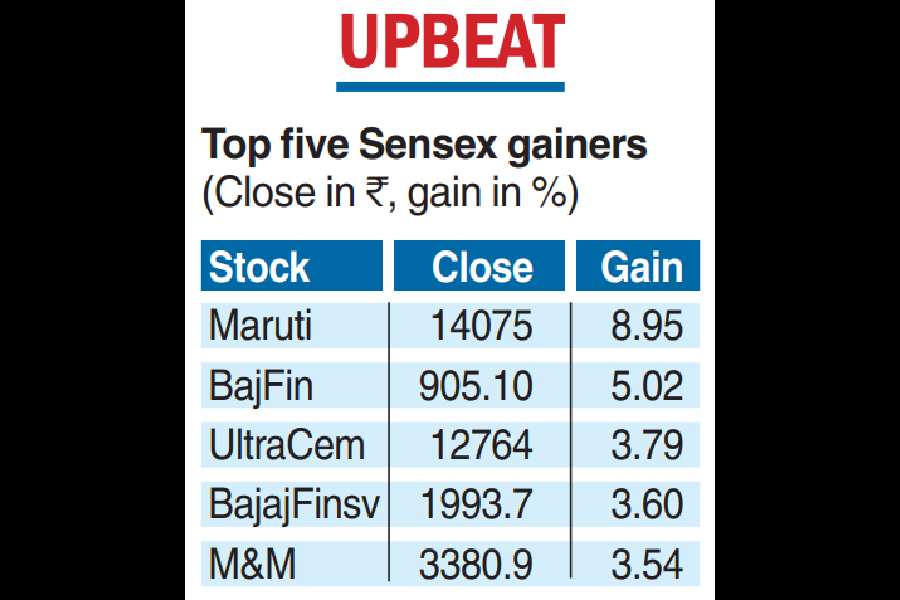

The Nifty was up 245 points at 24876.95, buoyed by heavy buying in automobile and consumer durables stocks, marking the most gain for the 50-stock index in seven weeks. Sensex was up 679 points to close at 81273.75. Sectoral indices BSE Auto and BSE Consumer Durables were up 4.26 per cent and 3.08 per cent, respectively. However, indices like BSE Information Technology and BSE Power were down 0.43 per cent and 0.07 per cent, respectively.

"The proposed rationalisation of GST is a sentiment booster for the domestic market. Additionally, the recent conclusion of the US and Russia summit, without any escalation in geopolitical tensions, has helped ease investor anxiety,” said Vinod Nair, head of research, Geojit Investments Limited. “The automobile sector outperformed, emerging as a key beneficiary of the anticipated tax reforms,” Nair added.

“Markets staged a strong rally on Monday and ended with gains of over a per cent. The positive sentiment was driven by GST reform proposals, easing concerns over crude oil prices, and a sovereign rating upgrade, which together lifted investor confidence,” said Ajit Mishra, senior vice-president, research, Religare Broking.

“The Nifty witnessed a sharp up move on Monday on the backdrop of announcement of GST reforms and a positive geo-political climate,” said Nagaraj Shetti, senior technical research analyst at HDFC Securities.

The central government has proposed a two-tier GST structure of 5 per cent and 18 per cent, besides a 40 per cent special rate on a select few items, to the Group of Ministers on GST rate rationalisation. The proposal, which entails removing the current 12 per cent and 28 per cent tax slabs, will be discussed at the two-day meeting of the state ministerial panel on August 20 and 21 in the national capital, according to sources.

Prime Minister Narendra Modi had announced the proposal to reform the GST law in his Independence Day speech on August 15.

Within the broader market, the BSE smallcap gauge jumped 1.39 per cent, while the midcap index climbed 1 per cent. As many as 2,560 stocks advanced while 1,629 declined and 176 remained unchanged on the BSE.

Bond yields

Government bond yields surged on Monday amid fiscal concerns over the government’s plan to cut consumption taxes. The yield on the benchmark 10-year government bond rose by 10 basis points — its sharpest single-day rise since October 2023 — to settle at 6.50 per cent, against the previous close of 6.40 per cent. This wiped out all gains accrued on Thursday after S&P upgraded India’s sovereign credit rating from ‘BBB-’ to ‘BBB’.

Rupee gains

The rupee appreciated 20 paise to close at 87.39 against the US dollar on Monday, supported by strong domestic equities. Forex traders said the Indian rupee traded in the positive territory because of the proposed GST reforms.