|

Mumbai, Oct. 13: The Securities and Exchange Board of India (Sebi) has barred DLF and six of its top executives, including chairman K. P. Singh, from accessing the capital markets for three years for not disclosing information at the time of its initial public offering (IPO) in 2007.

Besides K. P. Singh, the other individuals to be barred are his son Rajiv Singh (vice-chairman), daughter Pia Singh (wholetime director), T. C. Goyal (managing director), Kameshwar Swarup and Ramesh Sanka. The accused cannot buy and sell shares from the market.

The Delhi high court in 2010 had asked Sebi to investigate the complaints filed by a certain Kimsuk Krishna Sinha.

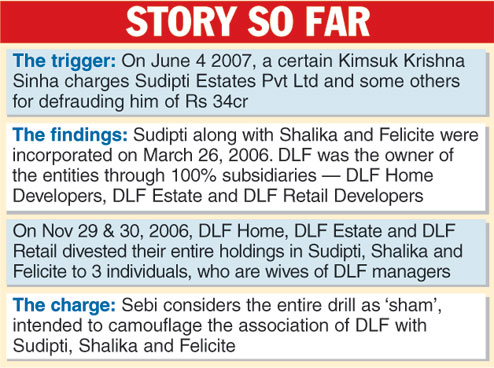

Sinha, in his complaint dated June 4, 2007, alleged that Sudipti Estates Pvt Ltd and some other persons had duped him of Rs 34 crore in a land purchase deal.

He alleged that Sudipti had only two shareholders — DLF Home Developers Ltd (DHDL) and DLF Estate Developers Ltd (DEDL).

Sebi in its showcause notice to the accused had said that DEDL, DHDL and another company DLF Retail Developers Ltd (DRDL) were subsidiaries of DLF.

The regulator found out that Sudipti along with Shalika Estate Developers and Felicite Builders & Construction were incorporated on March 26, 2006.

While DHDL and DEDL held 50 per cent each in Sudipti, the entire shareholding of Shalika was held by DHDL, DEDL and DRDL.

Similarly, they were the only shareholders in Felicite.

On November 29, 2006, the entire shareholding in Felicite were sold to three persons who were the wives of key management personnel of DLF.

On November 30, 2006, DHDL, DEDL and DRDL sold their entire shareholding in Shalika to Felicite, while DHDL and DEDL sold their shareholding in Sudipti to Shalika.

“The process of share transfer of three subsidiaries of DLF in Sudipti, Shalika and Felicite was through sham transactions and the noticees employed a scheme to camouflage the association of DLF with its three subsidiaries,” Sebi’s wholetime member Rajeev Kumar Agarwal said in his order. These information were deliberately suppressed in the red herring prospectus of DLF to mislead the investors, Agarwal averred.

On its part, DLF said the order dated October 10 came to its notice only today and the same is being reviewed. The company further said it has not violated any laws and it would defend its position against any adverse findings.