Virtue, profit and pleasure are the first duties of a king and all of them when closely knit have good and evil effects. The king should extract the effects that are good and avoid those that are evil...

This aphorism from the Mahabharata, which narrates the fate of the Pandava and Kaurava princes through the Kurukshetra war, gives an insight into the virtues one should possess in life and which can be replicated in the world of investment too. Extract the effects that are good in any particular situation - that's the bottom line. Though the narrative dates back to many millennia ago, there are some definite parallels that can give a new dimension to the present cut-throat financial world.

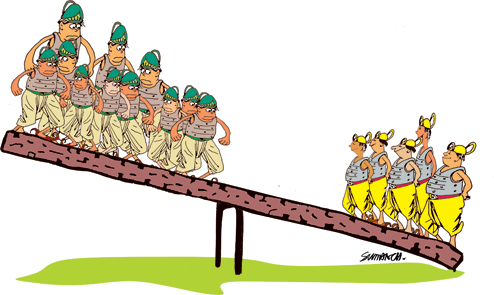

Five against hundred

In the Mahabharata, the battle was between the Pandava family, consisting of just five brothers, and the entire Kaurava clan, comprising 100 members. Yet, the Pandavas prevailed. The lesson to be learnt is that cohesiveness and team spirit, and not necessarily numbers, can bring success. The same spirit can be followed while diversifying your portfolio.

Over-diversification may not necessarily create more value for you. As money is spread thinly across many investments, whether it is gold, equity or bonds, profit from any one investment could be marginal. By diversifying too much,there is a possibility that one can lose gains from profitable investments. Therefore, it is better to have five or six assets that can bring you solid returns.

For example, sometimes it is better to invest, say, Rs 50,000 in one good stock rather than putting Rs 5,000 in 10 different shares. Too much diversification may become cumbersome to manage and the transaction cost involved in portfolio management could be a dampener too.

Seize opportunities

A good investor should lie low and grab the opportunities such as a good price or scheme to profit out of the investment. Someone who is interested in investing in stocks and has time in hand can look to park money in shares of a small company with great potential. Many may write off these companies as they are small or the rate of appreciation is low. However, the opportunity can be immense.

Those interested in buying gold and silver can also take advantage of current falling prices and realise gains as the rates are bound to go northwards in the future.

A leaf could be taken out of the Mahabharata on seizing opportunities. As part of preparing for the war, the Pandavas grabbed the opportunities that came their way unlike the Kauravas who only made new enemies. While Arjuna went on a mission to acquire divyastras, Bheema took Hanuman's advise to build more strength. Yudhisthira met many wise men also studied the nuances of the game of dice if he were to be challenged in the game again. In all these cases, the Pandavas realised the gains to be had by pouncing on the opportunities that presented themselves.

Portfolio distribution

One big mistake the Kauravas committed was to centralise leadership during the war. The responsibilities were not evenly distributed among the stakeholders. The Kaurava army had only one head. But the Pandavas had Dhrishtadyumna as the commander-in-chief, Arjuna as the supreme commander and Krishna as Arjuna's charioteer and counsellor.

Drawing parallels with the Mahabharata, there is also a need for even distribution as far as portfolio planning is concerned. While doing that one should consider the amount of capital to invest, time to grow money and the future capital needs.

A conservative investor who doesn't like to take much risk should have 70-75 per cent in fixed income avenues, 15-20 per cent in equities and 5-15 per cent in cash or equivalent.

However, when it comes to aggressive investors, the numbers may change to 60-65 per cent in equities, 30-35 per cent in fixed income avenues, and the rest in cash or liquid bonds. So, distribution of a portfolio is important for portfolio planning.

Commitment

A person with great commitment, rather than best capabilities, is the best man for a job. This kind of commitment was exemplified by young Abhimanyu, son of Arjuna, who penetrated enemy lines and laid down his life while taking down with him large numbers of the Kaurava army. The same is the case with Ghatotkacha, son of Bheema, who in his death turned the tables on the Kauravas. These two tales of bravery depict their extent of commitment.

In the world of finance too, commitment has a major role to play in long-term investment strategy. The best example is the systematic investment plans, which have varied plan periods from five to 20 years. Once the investor decides to be part of a SIP, he has to make sure that the requisite amount is remitted without fail.

When it comes to equity, the best investors are the ones who hold on to a winning stock for a long period of time. One should have faith in a scrip that it will do well and bring rewards when sold in the future. Of course, sufficient research and analysis should precede the decision.

Individual goals

Though the Pandavas had a common goal to win the war against the Kauravas, they had individual targets too. Arjuna's target was Karna, Bheema's agenda was to ravage Duryodhana and his brothers, Dhrishtadyumna had Drona on his radar, Sahadeva wanted to decimate Shakuni and his sons, while Nakula wanted to defeat Karna's sons.

The same principle works in the world of investment. An investor's common goal should be his overall financial stability while financial goal could be specific such as buying a house, funding children's education, closing a loan account or saving enough to ensure an easy retirement. The investor should decide which goals will be his priority.

When in crisis, it is always better to go back to the basics and start all over again. One can get inspiration and guidance from these epics, no matter how old they are as the psyche of human beings is depicted vividly in them. These treasure troves can be guiding lights for any investor.

The author is CEO of BankBazaar.com