Calcutta: Sajjan Jindal's JSW Steel has made the highest offer for Bhushan Power and Steel Ltd (BPSL), topping the bids of rival Tata Steel and Liberty House of the UK.

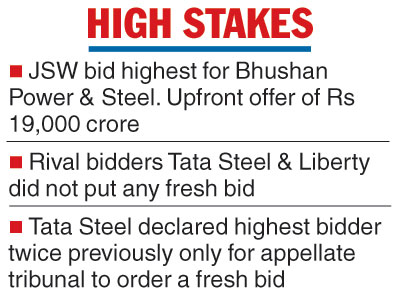

JSW Steel has made an upfront cash offer of Rs 19,000 crore to financial creditors who collectively have a claim of Rs 47,000 crore on BSPL.

The committee of creditors (CoC) of BPSL met on Tuesday to discuss the revised offers made by the three bidders.

While JSW sweetened its offer from the earlier bid of Rs 18,000 crore, Tata Steel and Liberty House did not rework their offers to the financial creditors, who form the CoC.

In the bankruptcy process in India, the CoC votes on the resolution plans submitted by the bidders and any upfront payment offered by the interested parties usually sways the vote.

JSW is yet to be officially communicated that it has been chosen as the highest bidder (H1) for BPSL. The issuance of the letter of intent (LoI) by the resolution professional of Bhushan based on the recommendation of the CoC would be the next step.

Industry observers, however, did not rule out legal challenges.

Given that neither Tata Steel, which had been twice declared the highest bidder (H1 ) for BPSL before the National Company Law Appellate Tribunal (NCLAT) ordered a rebid, nor Liberty increased their offers indicate they could take it up legally.

"Access to the eastern market and desire to retain the top slot among private sector steel makers may have driven JSW to up its numbers," a source with direct knowledge of the matter said.

Potential game changer

The acquisition of BPSL could decide who would hold the numero uno slot among private sector steel producers in India for a decade.

After the successful takeover of Bhushan Steel Ltd, Tata Steel has now an installed capacity of 18.5 million tonnes (mt) while JSW has 19mt in the country. JSW also managed to acquire Monnet Ispat in partnership with private equity firm Aion.

Both the companies have plans to add capacities to their existing locations. Bhushan Power's 3.5mt unit at Odisha, which can be expanded to 5mt, will give the successful resolution applicant an edge that could be hard to overcome by the competitors.

Moreover, if the Jindals manage to buy Bhushan Power, they would have a formidable footprint nationally, by entering the eastern sector which has been traditionally dominated by Tata Steel, having plants in Jharkhand and Odisha.

In contrast, JSW has been a strong player in the southern market before it ventured into the west with the acquisition of Ispat Industries.