JSW Steel will soon start to procure nearly a two-third of its iron ore requirement from captive mines, becoming a vertically integrated player like Tata Steel and Steel Authority of India.

The company, promoted by billionaire industrialist Sajjan Jindal, plans to start production from four mines recently acquired through public auction in Odisha from July 1, while three more smaller ones in Karnataka will come on stream by this fiscal.

JSW, which operates two integrated steel plants in Karnataka and Maharashtra, will be capable of producing 36 million tonnes (mt) of iron ore at full throttle, meeting over 70 per cent of the peak requirement of 50mt.

Only Tata Steel and SAIL run fully integrated operations in India, sourcing 100 per cent of iron ore from their own mines, giving the duo complete control over the sourcing of the basic raw material. In contrast, JSW could only manage about 15 per cent requirement (4.11 million tonne) from captive sources.

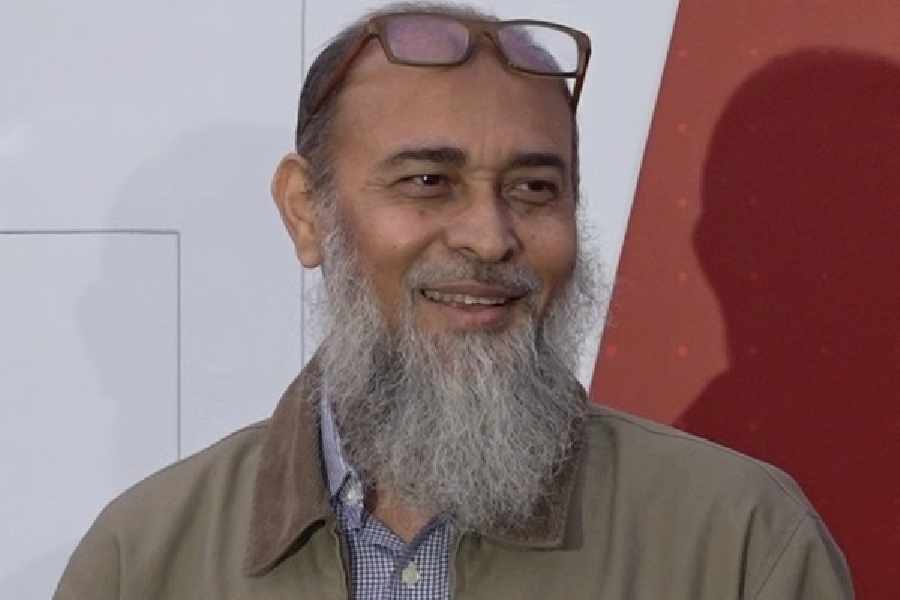

This is set to change. “This year the captive source of iron ore will be nearly 50 per cent. We have three more mines in Karnataka where availability is going up from 4mt to 7mt. We got four mines in Odisha through a recent bidding, where there is environment clearance up to 29mt. We want to make them operational by July,” Seshagiri Rao, joint managing director & CFO of JSW Steel, said.

According to the conditions in the tender, the company has to produce 80 per cent of the last two years’ average production, which stood at 20 mt, from the Odisha mines.

Accordingly, it has to produce 16mt which it plans to do this year, proportionate from July. Consequently, it is on course to lift at least 12mt from the Odisha mines and about 7mt from Karnataka in 2020-21.

Going forward, it can ramp up to 29mt from Odisha when Dolvi (Maharashtra) expansion comes on stream and Bhushan Power and Steel Ltd comes under the JSW’s fold.

“This will add a lot of flexibility to JSW, reducing dependency on merchant miners. Some of them (ore) are high grade, low on alumina which will increase blending quality. Logistic cost will also come down. So that is one value addition that will come this year,” Rao said.

The company informed the investors that expansion of Dolvi to 10mt from 5mt would be delayed to March 2021 from September as guided earlier.

The number of workers at the site has come down from 15,000 to 4,500 during the lockdown as many headed back home.

The situation is the same for all ongoing downstream projects. Accordingly, capital expenditure has come down to Rs 9,000 crore, including Rs 800 crore for development of mines, from Rs 16,000 crore projected earlier.

JSW has set a guidance for 16mt production (16.06mt last year) and 15mt sales (15.08mt last year) in 2020-21. After Dolvi completion, the capacity will go to 23mt, while BPSL and Monnet would add another 4mt.

The BPSL acquisition, as part of its insolvency process, is now at the Supreme Court. This is expected to be cleared during the year.