ITC Ltd has hatched a plan to spin off its hotels business into a separate entity, kicking off a process to unlock value from the conglomerate structure in line with the long standing demands of shareholders and investors.

The entity, likely to be called ITC Hotels, will be listed on the bourses pursuant to receipt of appropriate regulatory approvals, which could take at least a year, unravelling a structure knitted two decades back.

The ownership of the hotel business was split among ITC Ltd, Ansal Properties and ITC Hotel Ltd, which used to be a separate listed entity, prior to a merger effective April 1, 2004.

Following the consolidation, ITC Ltd carried on the hospitality business, rapidly scaling up its presence by building some of the most expansive hotels across the country, including ITC Sonar and Royal Bengal in Calcutta.

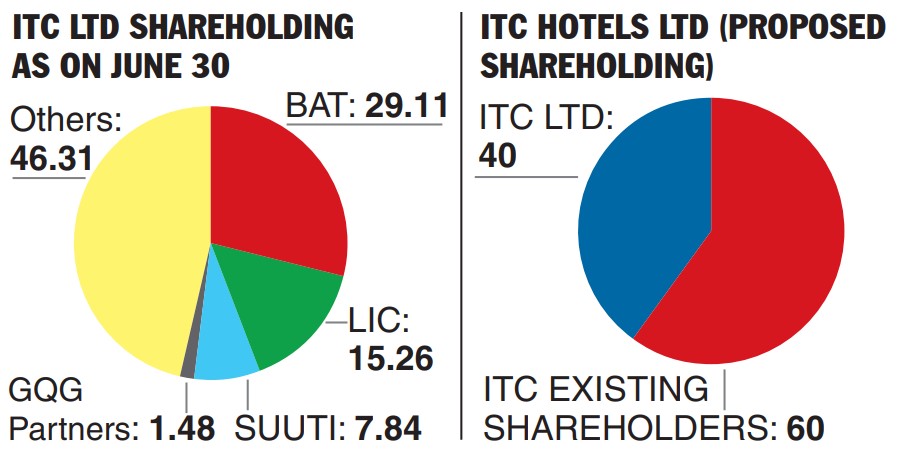

In the corporate structure now being proposed, ITC Ltd will have a direct stake of 40 per cent, while the shareholders of ITC will get the balance 60 per cent proportionate to their holding in ITC Ltd.

ITC’s stake, akin to a promoter’s holding, will ensure stability and continuity of the hotel business while harnessing the enterprise strength of the conglomerate which has a strong presence in linked sectors such as FMCG, agriculture and packaging.

The balance stake, in contrast, is going to give existing shareholders an exit option while opening the door to appropriate investors and strategic partners who are keen to participate exclusively in the hospitality sector.

The ITC board accorded an in-principle approval to the demerger of the hotel business under a scheme of arrangement and incorporation of a wholly-owned subsidiary on Monday.

Details of the proposed reorganisation, including the scheme of arrangement, shall be placed for approval of the board at its meeting on August 14, 2023.

In a statement, the company said this move also reinforces the sharper capital allocation strategy put in place in recent years, manifested in the pivot to ‘asset-right’ strategy in the hotels business.

After ploughing in internal resources to build properties, it is now focusing on management contracts. ITC now owns and manages 120 hotels having 11,600 rooms in 70-plus destinations under ITC Hotels, Mementos, Welcomhotel, Stori, Fortune brands. Half of the rooms are now under management contract.

The Telegraph

Commenting on the development, Sanjiv Puri, chairman of ITC, said: “The proposed demerger of the hotels business is a testament to the company’s commitment to creating sustained value for stakeholders. Creation of a hospitality focused entity will engender the next horizon of growth and value creation by harnessing the exciting opportunities in the Indian hospitality industry. In the proposed reorganisation, both ITC and the new entity will continue to benefit from institutional synergies.”

In FY23, the hotel business had posted a revenue of Rs 2,689 crore and an EBIT (earning before interest and tax) of Rs 557 crore, representing 3.2 per cent and 2.2 per cent of ITC’s revenue and EBIT.

On July 5, Nuvama Institutional Equities had accorded Rs 8 a share value to the hotel business on SoTP (sum of total parts) basis with a target price of Rs 500 for ITC.

After the announcement, the ITC stock slumped by 3.87 per cent, or Rs 18.95 apiece, to close at Rs 470.90 on the BSE. It had touched an all time high of Rs 499.60 prior to it.