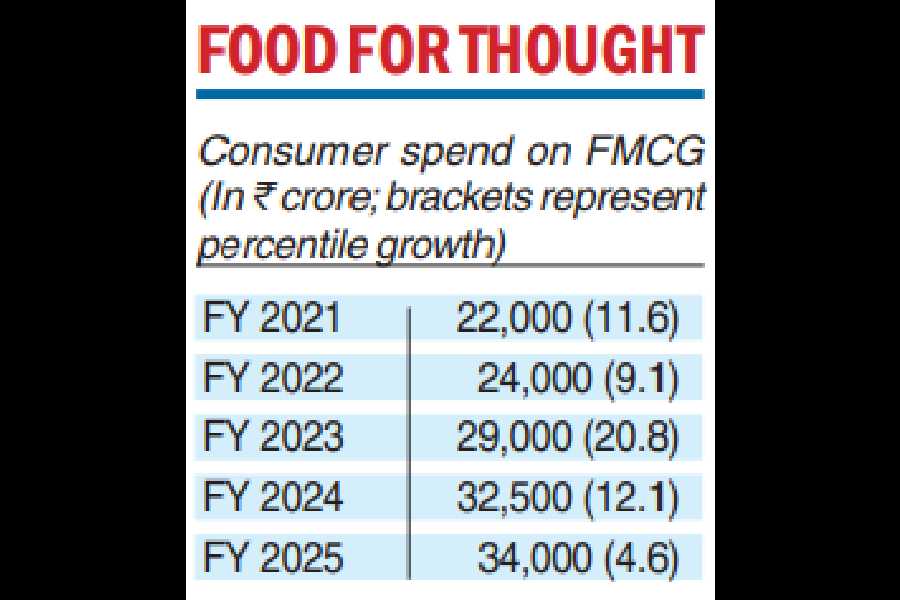

Consumer spend on ITC’s FMCG products, which include branded packaged food and personal care, reached ₹34,000 crore in FY25, growing at the slowest pace in the last five years, albeit on a higher base. The company had reported a consumer spend, which captures net sales (sans offers and discounts) in addition to trade margin and taxes, of ₹32,500 crore last year, which was a growth of 12.1 per cent over the previous fiscal.

ITC, which is based in Calcutta, said the FMCG sector experienced a muted demand growth due to weakness in consumption. “The impact of inflationary pressures on household savings weighed on consumption expenditure, particularly in urban markets. However, demand in rural markets was relatively resilient,” the management said in the latest annual report published on Friday.

Apart from weak demand, the company also faced increased competition in the marketplace in the personal care portfolio. The premium segment, however, continued to grow faster, reflecting an ongoing shift towards value-added offerings and increased demand for high-quality products.

The company, which continues to earn three-fourth of profit from cigarettes, however, was undeterred by the weak demand scenario and launched 100 new products across food and personal care segments. The company owns 25 brands, viz. Aashirvad, Sunfeast, Bingo among others.

It also snapped up a number of companies and brands such as Prasuma/ Meatigo, 24-Mantra Organic Foods and Mother Sparsh.

ITC held out hope that consumption expenditure is expected to pick up progressively, led by continued recovery in rural demand backed by a good monsoon, along with improvement in urban demand as inflation stabilises and tax cuts announced in the budget boost disposable incomes.

The FMCG businesses recorded a revenue of ₹21,981.57 crore, up 4.84 per cent from the previous year’s ₹20,966.83 crore, while segment EBITDA stood at ₹2,163.92 crore, down 7.4 per cent from ₹2,338.50 crore a year ago.

While the domestic market had a challenging year, the company was exploring greener pastures in the export market with packaged branded food with categories such as biscuits, noodles and snacks. It also accelerated export of value-added agri products such as shrimp, spices and coffee.