The Centre has proposed a two-tier GST rate structure of 5 and 18 per cent to replace the current indirect tax regime in a bid to reduce the tax burden on common people, drive consumption and boost the economy, which may face an external shock due to Trump tariffs.

The Centre has sent its proposal, which removes the 12 and 28 per cent slabs, to the panel of state finance ministers on GST rate rationalisation. They will now discuss it and place it before the GST Council, which is expected to meet next month.

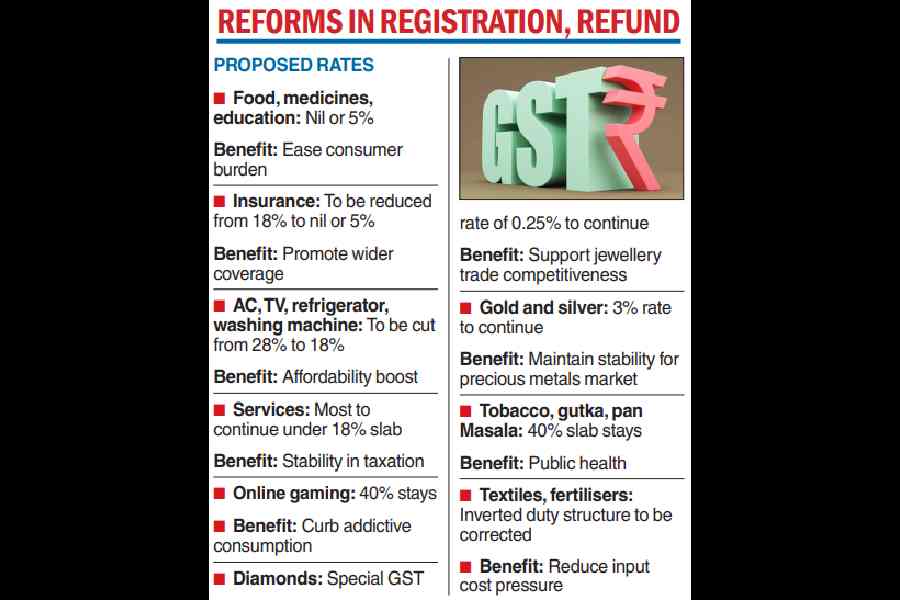

While nil or zero per cent GST is charged on essential food items, 5 per cent is charged on daily use items, 12 per cent on standard goods, 18 per cent on electronics and services and 28 per cent on luxury and sin goods, the revamped GST regime will have two slabs plus a special rate of 40 per cent for luxury and sin goods, sources said.

If the revamped structure is approved by the GST Council, 99 per cent of items in the current 12 per cent slab will move to the 5 per cent bracket. Almost 90 per cent of goods and services that are currently charged at 28 per cent would shift to an 18 per cent tax rate.

The special rate of 40 per cent would be levied on only about seven items, sources said, adding tobacco would also fall under this rate, but the total incidence of taxation would continue at the current 88 per cent. Online gaming is also likely to be treated as a demerit goods category and attract the highest tax rate.

As many as eight sectors — textiles, fertiliser, renewable energy, automotive, handicrafts, agriculture, health and insurance — will benefit the most from the GST rate overhaul. The revamped GST is expected to give a big boost to consumption.

“There will be a gap in revenues because of the rejig, but the revenue will be offset in the next few months,” a government source said, adding that the new slab structure would be implemented by the early third quarter.

A key monitorable in the Centre’s proposal will be the response of the opposition-ruled states such as Bengal, Tamil Nadu, Karnataka, Kerala and Punjab, among others. They would be wary of any potential revenue loss from the rate rejig, given the importance of GST revenue to their tax collection.

“The Centre will be building a broad-based consensus in the coming weeks to implement the next generation of reforms,” the ministry added.

Present structure

Under the present GST structure, which came into being after central and state levies were subsumed from July 1, 2017, the highest 65 per cent tax collections come from the 18 per cent levy. The top tax bracket of 28 per cent on luxury and sin goods contributes 15 per cent of the revenue, while the 12 per cent slab accounts for just 5 per cent.

High labour-intensive and export-oriented sectors like diamonds and precious stones would continue to be taxed under the existing rates.

Elaborating on the timing for reforms, government sources said “piecemeal GST rate changes” could not have happened now, as the compensation cess, which is levied on luxury and demerit goods, was coming to an end once the repayment of the borrowed loans is complete. Multiple GST rates in the supply chain were leading to evasion as fraudsters were generating fake invoices to claim input tax credit.

Structural changes

The GST reforms will also seek to reduce classification-related disputes, correct inverted duty structures in specific sectors, ensure greater rate stability, and further enhance ease of doing business.

The structural reforms would ensure stability and predictability by providing “long-term clarity on rates and policy direction to build industry confidence and support better business planning”.

On the ‘ease of living’ side, the finance ministry’s proposal includes seamless, technology-driven GST registration, especially for small businesses and startups. It also suggested the implementation of pre-filled GST returns and faster and automated processing of refunds for exporters and those with an inverted duty structure.

“We applaud a comprehensive GST review after eight years, which will reduce the tax burden and enhance the ease of doing business,” said Harsha V. Agarwal, president of Ficci.