Forex traders are concerned about a further depreciation of the Indian Rupee against the US Dollar in the near term and economists have called for a need to keep an eye out for current account deficit amid an apprehension of imports becoming expensive with the domestic currency falling by over 2 per cent in July against the greenback — its worst fall since September 2022.

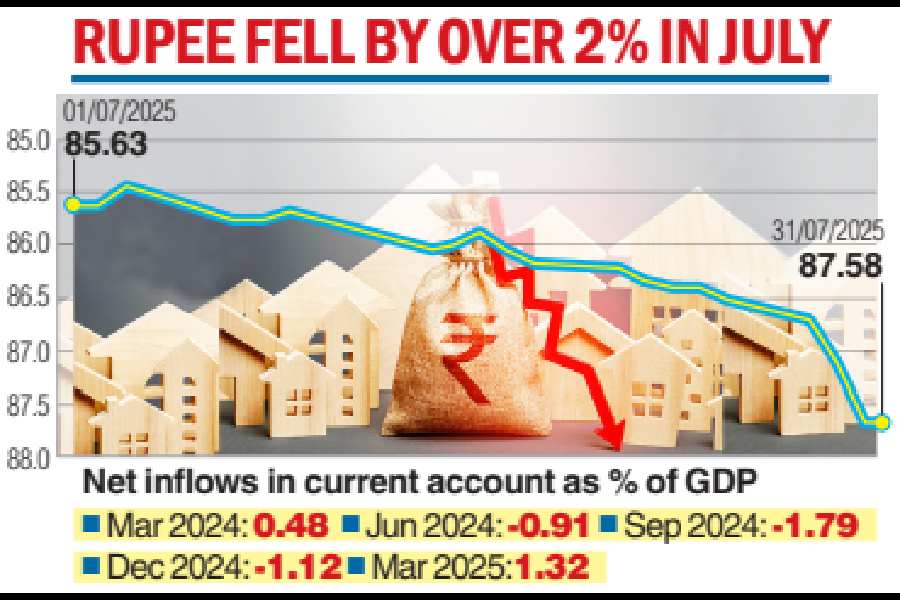

The rupee closed the month at 87.58 against 85.6 on July 1, 2025 (see chart).

On Thursday, at the interbank foreign exchange, the rupee opened at 87.66 against the US Dollar, touched an intra-day low of 87.74 before recovering to 87.58 (provisional). The currency had posted its steepest one-day drop in over three years on Wednesday.

Persistent sell-off by foreign investors, driven by geopolitical uncertainties and subdued start to June quarter earnings, along with US President Donald Trump’s threat on Wednesday of a 25 per cent tariff on Indian imports with an unstated penalty for buying Russian crude, has heightened the caution on the currency.

“Level 88 looms as a big point on the charts and likely a focus for the RBI as well,” said Brad Bechtel, head of global FX at Jefferies. “Will be interesting to see if they allow the currency to depreciate through that level to offset the impact of tariffs or if they fight to maintain currency ‘stability’,” he said.

Till there is clarity on the tariff front, pressure on the rupee is likely to persist, CR Forex Advisors MD Amit Pabari.

Economists also said that the rupee is expected to remain under pressure in the near term, and the outcome of the bilateral trade agreement between India and the US will remain a key monitorable.

“If the rupee continues to depreciate, India’s oil import bill could inflate, and the current account could come under pressure. The US has already sanctioned six Indian companies for allegedly trading in Iranian petroleum and petrochemical products and has indicated a penalty if crude oil is imported from Russia. What is crucial now is to see how the trade deal with the US (country’s largest trading partner) takes shape,” N.R. Bhanumurthy, director, Madras School of Economics, told The Telegraph.

The current account was in a surplus of 1.3 per cent of GDP in Q4FY25 against 0.5 per cent in Q4FY24.

“We expect the rupee to remain under pressure in the near term. However, we maintain our forecast for USD/INR in the 85–87 range by end-FY26, supported by a weaker dollar, a stronger Chinese Yuan, and India’s manageable current account deficit.

“Further, India–US trade negotiations are expected to continue and could provide some reprieve. While India is likely to remain cautious about opening sensitive sectors such as agriculture and dairy, we expect an India-US trade deal to be reached over time, which should also support the currency,” said Rajani Sinha, chief economist, CareEdge Ratings.