Mumbai, June 30: HDFC Bank expects close to 60 per cent of the transactions by its SME (small and medium enterprises) clients to shift to its digital banking channel over the next one year.

The country's second-largest private bank serves close to one lakh of the 3.6-crore SME units in the country.

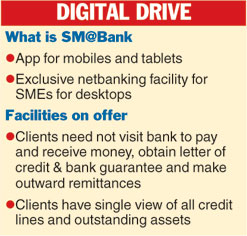

HDFC Bank today launched SM@Bank, a digital service for the SME sector, which will allow clients to access a complete suite of services across various devices such as desktop, laptop, tablet and mobile. According to the lender, customers will no longer need to call a relationship manager or visit a branch.

SM@Bank is the second leg of a campaign that was launched by the lender for its retail customers in December 2014. The new initiative brings the benefits of digitisation to corporate clients, beginning with the SMEs.

The new facility will provide clients with a single view of all their credit lines with the bank and outstanding assets. Customers can also pay and receive money without using a cheque book, obtain letter of credit and bank guarantee and make outward remittances. Moreover, documents such as stock statements, insurance and financials can be uploaded to the bank database for smooth continuation of credit facilities.

"We believe that this will transform the way SMEs bank today. At the heart of it is speed, convenience, transparency and predictability. Entrepreneurs can use the time saved to focus on their core business without having to worry about their banking needs. This will improve their efficiency and productivity,"Aseem Dhru, group head (business banking) at HDFC Bank, said at the launch of the facility today.

Dhru said the bank had a market share of 7 per cent in SME financing. The lender's SME loan book has grown 30 per cent and is expected to increase further following the digital banking initiative.