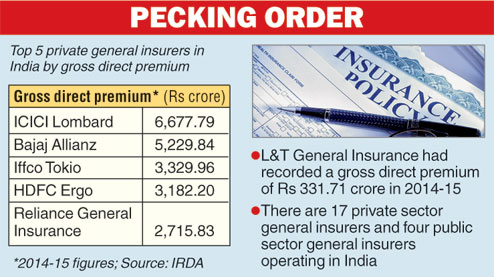

Mumbai, June 3: HDFC ERGO, the fourth largest private sector general insurer, will acquire smaller rival L&T General Insurance in an all-cash deal for Rs 551 crore.

HDFC ERGO, which is a 51:49 joint venture between HDFC and ERGO International, Germany (part of Munich Re Group), will acquire 100 per cent of L&T General Insurance.

The transaction also envisages the subsequent merger of the two insurance companies.

The merger process is expected to take about 11 months.

The deal is subject to various approvals, including a nod from the insurance regulator, Bombay High Court and the Competition Commission of India.

In a statement, Larsen and Toubro said following the sale, the group would exit the general insurance and health insurance businesses. The share sale is part of a strategy to exit non-core activities.

"Considering the importance of scale in the insurance business, consolidation within the insurance industry is inevitable. This transaction marks the beginning of this consolidation phase," Deepak Parekh, chairman of HDFC and HDFC ERGO General Insurance, said.

"The acquisition will help HDFC ERGO to further strengthen its presence in the market. The combined size and expertise will result in improved cost efficiencies in the merged entities and benefit policy holders and other stakeholders," he said.

Arpwood Capital was the exclusive financial adviser to HDFC ERGO.

Set up six years ago, L&T General Insurance (LTGI) is a wholly owned subsidiary of engineering conglomerate Larsen & Toubro.

LTGI's gross earned premium for the year ended March 31, 2016 stood at Rs 483 crore, a growth of 40 per cent over the previous year. This was close to 0.5 per cent of L&T's consolidated revenues during the period.

Data available from the website of the company showed that the insurer suffered losses of around Rs 102 crore during 2015-16.

LTGI operates through 28 offices and has an employee strength of over 800.

In the same year, HDFC ERGO, which has 108 offices and an employee strength of 2007, earned a gross premium of Rs 3,467 crore and made a profit after tax of Rs 151 crore.

According to HDFC ERGO, the acquisition will enable it to improve its market position.

HDFC ERGO also expects significant cost synergies arising out of business, technology optimisation and rationalisation of offices.

HDFC ERGO offers all lines of general insurance products, including motor, health, personal accident, home, fire, marine, aviation, liability and crop insurance.

Share transfer

HDFC today said in a stock exchange filing that it has concluded the transfer of its 23 per stake in the general insurance venture to ERGO, which has resulted in a pre-tax profit of Rs 922 crore.

As HDFC Ergo is an unlisted entity, the capital gains tax on the sale of shares is Rs 197 crore, resulting in a post-tax profit of Rs 725 crore.

As a result of the sale of shares, HDFC's holding in HDFC Ergo comes down to 50.73 per cent, while that of Ergo rises to 48.74 per cent.