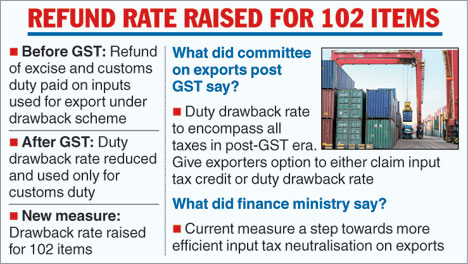

New Delhi: In a move to make exports competitive in the global market, the government has increased the duty drawback rates of 102 products including marine and seafood products, automobile tyres and bicycle tyresubes, leather and articles made of leather.

"As a step towards more efficient input tax neutralisation on exports, after considering various representations from trade and industry, the government of India has enhanced the all industry rates of duty drawback for 102 tariff items. The revised rates of duty drawback will help address the concerns of these export sectors and make India's exports more competitive in the global economy," the finance ministry said in a statement.

The export items that will now enjoy a higher duty drawback include marine and seafood products, automobile tyres and bicycle tyresubes, leather and articles made of leather, yarn and fabric made of wool, glass handicraft and bicycles. Duty drawback compensates exporters for the duties paid on inputs used to manufacture exported products.

"It is a welcome move. This would provide some competitiveness to Indian exporters in the global market," the Federation of Indian Export Organisations (Fieo) director-general Ajay Sahai said.

Under the pre-GST regime, the government used the duty drawback scheme to refund both excise and customs duties paid on inputs used for exports. However, after the GST was introduced, the government reduced the duty drawback rates and allowed them to be used only for customs duty refunds on inputs used.

The parliamentary standing committee on commerce, in its report on "impact of GST on exports" released last month, said both direct and embedded tax refunds under the new GST system are very complicated for small exporters who do not have adequate backoffice capability.

"The committee recommends that the government provide for a duty drawback rate which would encompass all the taxes including the GST/IGST levied as well as embedded/blocked tax and give a choice to the exporters to either claim the duty drawback or follow the input tax credit route. This will also release the pressure on the GST Network," it said.

Deep impact

The committee said the sudden withdrawal of the incentives extended earlier under the duty drawback scheme will lead to the collapse of labour-intensive industries and expressed deep concern over the possibility of job losses. The committee said it was informed that the trimming down of the duty drawback scheme and the consequent erosion of export competitiveness had already set in the problem of layoffs.

The cumulative value of exports for April-December, 2017-18, was $223 billion, a growth of 12.05 per cent and imports expanded 21.76 per cent to $338 billion, widening the trade deficit to $114.85 billion.

Gems and jewellery exports contracted 4.65 per cent to about $25 billion during April-December this fiscal owing to demand slowdown in major markets, including the US.

According to the Gems and Jewellery Export Promotion Council (GJEPC) data, exports stood at $26.1 billion in the same period last year. The labour-intensive sector contributes about 14 per cent to the country's overall export.