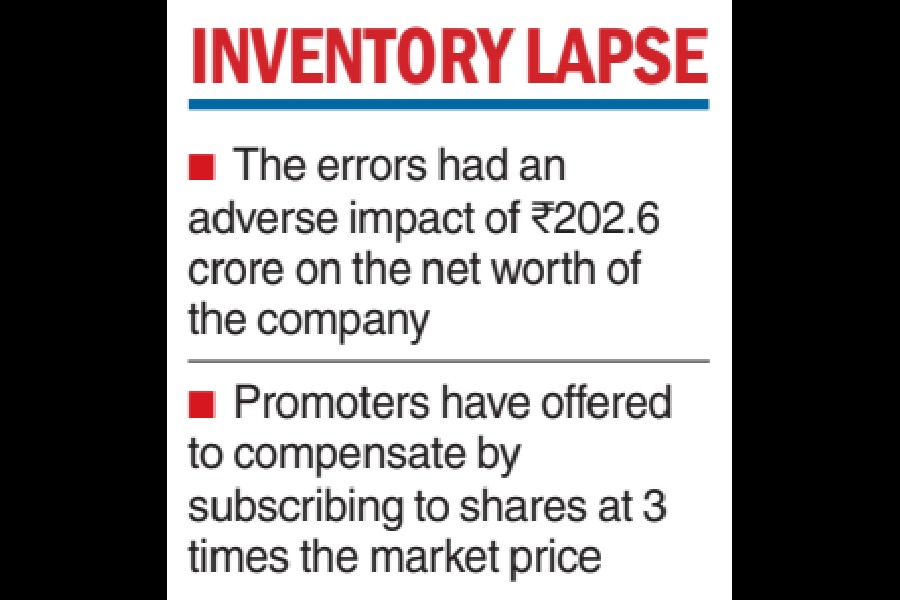

A joint fact-finding exercise by three independent agencies has established erroneous entries in the books of Ramkrishna Forgings Ltd (RKFL), India’s second largest forging producer, resulting in an adverse impact of ₹202.6 crore, or about 6.73 per cent of the net worth of the company.

The errors relate to overstatement of the company’s inventories in the balance sheet compared with the actual physical inventories RKFL held in the manufacturing plants.

An on-ground verification in April by the company revealed the discrepancies, which led the audit committee of the board to appoint external agencies to carry out fact finding study.

The final report of the study done by CLA VC LLP (erstwhile Baker Tilly Private Limited), Salarpuria & Partners and CLA IVC Private Limited was submitted to the audit committee and the board on Saturday.

The report established the overstatement of work in progress/raw material and scrap inventory by ₹220.53 crore for FY25 and ₹50.22 crore for FY24. In effect, the hit to the net worth was ₹202.6 crore (net of taxes).

The company management insisted that the discrepancies were non intentional and there was no fraud, which has been borne out by the joint fact-finding study. The promoters of the company said they intend to make good the losses to protect the interest of the minority shareholders.

“It is a human error by people on the shopfloor who make entries and use the system. The report established that it was non-intentional and not a fraud.

“We have already provided for this amount in our balance sheet. We have appointed an agency to fix wherever there is lapse in the system,” Naresh Jalan, managing director of RKFL, told The Telegraph.

Apart from placing internal controls, the management is in the process of appointing an external SAP consultant to review the existing production process in SAP and recommend actions to be taken towards strengthening controls and streamlining SAP processes, which is expected to be completed over the next 4-6 months.

Moreover, promoters, who hold 43.13 per cent share in RKFL, are making good the shortall by subscribing to shares at three times the market price.

“As the promoter, I have taken moral responsibility. I have decided to put the equivalent amount of the accounting error in the company to compensate the minority shareholders through warrants,” Jalan added.

The warrant will be issued at ₹2,100 crore per share and converted to equity within 18 months, subject to the approval of the shareholders at the extraordinary general meeting scheduled later in June.

RKFL’s stock closed at ₹648.4 a share on the BSE on Monday. By agreeing to pay thrice the market price, the dilution of shareholding will be limited to 0.5 per cent, which will boost returns for minority shareholders, the company said in an analyst call.