The spanner

Legal experts say ESIL’s route to recovery would surely be delayed by a spate of legal cases and the matter would finally be decided by the Supreme Court.

Ruias reminded that exception has been made in the case of Essar when ArcelorMittal was allowed to cure ineligibility by paying loans of non performing assets linked to it. In the same spirit, an opportunity should also be given to the shareholders of Essar to take the company out of IBC.

The Supreme Court, in its October 4 judgment, however, made exception to ArcelorMittal as well as Numetal. While ArcelorMittal obeyed the order and paid Rs 7,469 crore on accounts of Uttam Galva and KSS Petron, Numetal did not pay up the loans for all NPAs linked to Essar group entities. It is not yet known whether the combined payout to Ruias after adhering to 29A of IBC and the apex court judgment would be any less than Rs 54,389 crore, with an upfront cash component of Rs 47,507 crore.

Ruias said they should not be denied an opportunity to take the company out of IBC under 12A to maximise value for all ESIL stakeholders. Essar was admitted on August 2, 2017 and the EoI date was October 20, 2017, while the 12A amendment specifying guidelines of withdrawal came in on June 6, 2018.

Ruias added that they had offered a comprehensive plan to the CoC in April and July 2018.

Krishnava Dutt, managing partner of solicitor & advocate Argus Partners, sums up the legal conundrum in a tweet: “Don’t know who will finally win in the #EssarSteel battle, but one thing for sure #IBC is the winner here. Will eagerly wait to see whether Supreme Court will use article 142 for ‘maximisation of value’”.

Lenders of Essar Steel have rebuffed the counter-offer of the Ruias, the existing promoter of the company, and backed a competing plan of ArcelorMittal, signalling a fresh round of legal battle and delayed revival of the bankrupt producer of the alloy.

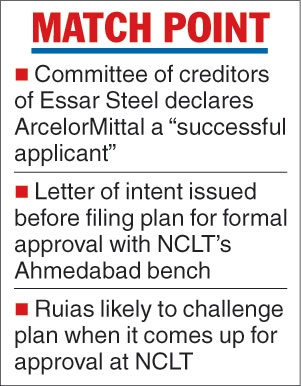

The committee of creditors of Essar Steel India Ltd (ESIL) declared ArcelorMittal a “successful applicant” and issued a letter of intent to the company before filing the resolution plan for formal approval to the Ahmedabad bench of the National Company Law Tribunal.

The Ruias did not directly respond to the snub even as sources close to them indicated that they would challenge the plan when it comes for approval at the NCLT.

The plan

ArcelorMittal and its Japanese partner Nippon Steel and Sumitomo Metal Corporation (NSSMC) will jointly own and operate the plant after the conclusion of the deal.

The JV will be funded by 2:1 debt to equity with the partners contributing to the equity. The plan involves upfront cash payment to the creditors of ESIL and Rs 8,000 crore infusion of liquidity into the company for future operations.

According to the details of the plan, submitted to the bourses where ArcelorMittal is listed, the company plans to ramp up ESIL’s finished steel shipments to 8.5 million tonnes (mt) over the medium-term from the present level of crude steel production of 6.5 million tonnes.

“This will be achieved by initially completing ongoing capital expenditure projects and infusing expertise and best practice to deliver efficiency gains, and then through the commissioning of additional assets, while simultaneously improving product quality and grades to realise better margins,” the company said in a statement.

Over the long term, there is a plan to increase finished steel shipments to between 12 mt and 15 mt through the addition of new iron and steel making assets.

Telegraph infographic