The mutual fund industry saw a fourth consecutive month of moderation in inflows into equity funds as investors exercised caution in a volatile market amid the escalating cross-border tension.

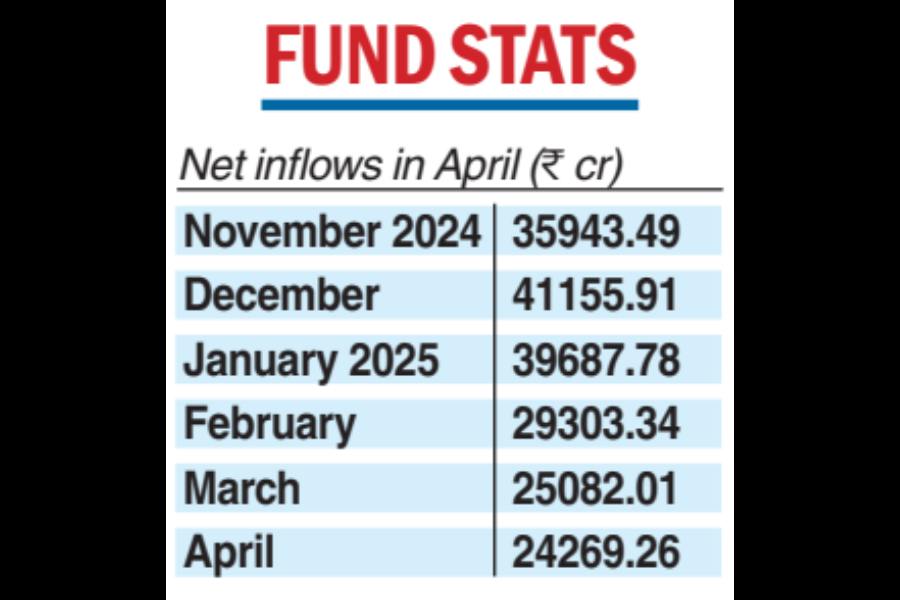

Net inflows into equity funds in April were down 3.24 per cent at ₹24,269.26 crore against ₹25,082.01 crore in March.

Value/contra funds, which invest in underperforming stocks, saw a sharp correction in inflows at ₹1,073.21 crore against ₹1,553.43 crore in March. Flexi cap funds recorded the highest inflows, attracting ₹5,542 crore. However, equity-linked saving schemes saw an outflow of ₹372 crore. Mid-cap and small-cap mutual funds saw inflows of ₹3,314 crore and ₹4,000 crore, respectively. Large-cap funds received ₹2,671 crore compared with ₹2,479 crore in March. The trend reflects a conservative approach on the part of investors to minimise capital erosion.

Hybrid schemes saw an inflow of ₹14,247.55 crore against an outflow of ₹946.56 crore in March. Debt funds saw an inflow of ₹2,19,136.27 crore against an outflow of ₹2,02,663.04 crore in March. These together pushed the overall assets under management to ₹69,99,837.94 crore, up 6.5 per cent from ₹65,74,287.20 crore in March.

“Net equity inflows have remained positive for the last 50 months. However, in April, net inflows declined 3 per cent sequentially. Large-cap funds bucked this trend. Other ETFs also witnessed a 50-month high inflows,” said Sanjay Agarwal, senior director, CareEdge Ratings.

“Systematic investment plans surged to an all-time high of ₹26,632 crore in April, driven by a steady increase in the number of contributing accounts, which now total 8.38 crore,” said Venkat Chalasani, chief executive, AMFI.

“The SIP conveyor belt remains the market’s behavioural anchor. Monthly contributions have marched to a record ₹26,600-plus crore, now funding a fifth of industry assets and cushioning drawdowns in high-octane segments,” said Karthick Jonagadla, smallcase manager and founder at Quantace.