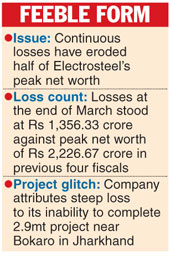

Calcutta, Aug. 9: Electrosteel Steels is going to be reported to the Board for Industrial and Financial Reconstruction (BIFR) after continuous losses have eroded half of its peak net worth.

The company has called an extraordinary general meeting on September 11 to consider the erosion and report the company to the BIFR in accordance with the provisions of Section 23 of the Sick Industrial Companies (Special Provisions) Act, 1985 (SICA).

The city-based company's accumulated loss at the end of March stood at Rs 1,356.33 crore against the peak net worth of Rs 2,226.67 crore in the preceding four financial years. As a consequence, it will now be called "potential sick company".

According to SICA, a company has to report to the BIFR if more than half of its peak net worth of the last four fiscals is eroded. If the net worth is fully eroded, the company has to be referred to the BIFR.

The decision comes at a time the lenders to the debt-laden steel maker has invoked strategic debt restructuring (SDR) following the Reserve Bank of India's circular of June 8, 2015. ESL has over Rs 9,600 crore debt on its books.

The development highlights the concerns voiced by RBI governor Raghuram Rajan in the latest monetary policy where he listed the steel sector as the biggest contributor to the alarming level of non-performing assets (NPA) in the banking system.

Project woes

In a note to the shareholders, the company has blamed the external environment for its inability to complete the integrated 2.9-million-tonne (mt) steel project near Bokaro in Jharkhand, resulting in steep losses.

"Delay in the execution of the project mainly because of a change in the visa policy for Chinese workforce deployed, problems in aggregation of land, necessity to hire local workmen, adverse operating and financial leverage and delay in sanction and disbursement of required project loan resulted in huge overrun and caused non-achievement of performance and profitability and thereby losses," ESL said.

Moreover, delay in the sanction and disbursement of "need-based working capital" resulted in lower capacity utilisation and lower cash flow generation, it added.

Raising funds

ESL was one of the few companies that managed to achieve financial closure following the global financial market meltdown triggered by the fall of Lehman Brothers in 2008.

A consortium of 30 lenders, led by the State Bank of India, approved a debt of Rs 5,447 crore in August 2009 at a time JSW Group failed to secure a loan for its steel and power project in Salboni, Bengal.

Even though there was a contraction in steel demand globally, ESL decided to raise capacity to 2.2mt from 1.3mt. Later, it was scaled up to 2.9mt. Moreover, Electrosteel Casting Ltd, a pioneer in ductile iron pipe and promoter of ESL, came up with the requisite equity.

The company wanted to check costs by tying down construction costs and deployed Chinese contractors. The government crackdown on visa delayed the project by at least a year. Meanwhile, demand for the alloy slowed down in the country.

In 2013, the company went to the corporate debt restructuring cell where the then existing Rs 6,800-crore term loan was to be recast, including a moratorium on principal and interest payment and the reduction of interest rate. ESL was supposed to get Rs 1,100 crore to complete the remaining project.

However, the CDR did not work out for ESL either. The situation got further aggravated when parent ECL lost the Parbatpur coking coal mine following a Supreme Court judgment in September 2014.

The lenders have now decided to convert part of the debt into equity according to the SDR mechanism and bring in a new equity partner. Initially, Tata Steel and a Singapore-based investment company had showed interest.