Calcutta: Electrosteel Castings (ECL) has booked a loss of Rs 578.68 crore after losing Electrosteel Steels (ESL) to Vedanta through the bankruptcy process.

While announcing the results for the June quarter, ECL disclosed the exceptional loss in the profit & loss account, following an NCLT order declaring Vedanta as the successful bidder.

After Anil Agarwal's Vedanta took over ESL, fresh shares were issued to the lenders for the conversion of loan to equity as well as to the new owner of the company. Moreover, existing share capital was reduced and restructured whereby 50 old shares were consolidated into one new share of Rs 10 face value.

"Pursuant to issuance of additional shares by ESL for giving impact of resolution plan of the successful bidder, as confirmed by NCLAT by its reserved order dated May 30, 2018, ESL has ceased to be an associate of the company in quarter ended June 30, 2018.

"To comply with the requirements of Ind AS 109 'Financial Instruments', the company has fair valued the investment in ESL and a sum of Rs 578.68 crore representing the difference between the carrying value of the said investment and the fair value on the date of change of status has been considered as an exceptional item in the statement of profit and loss," ECL said.

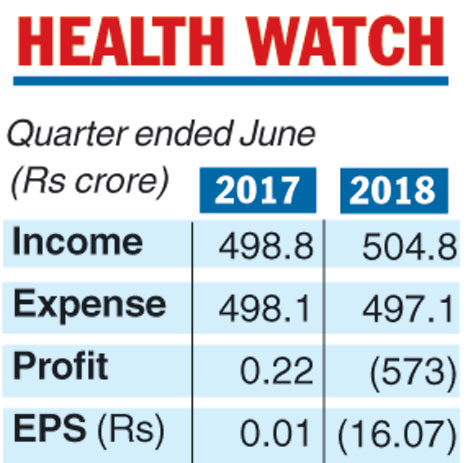

Prior to the exceptional loss, ESL had a profit before tax of Rs 7.6 crore compared with Rs 0.69 crore a year ago.

As a backward integration drive, ECL had built the integrated steel plant at Bokaro under ESL. However, the project ran into trouble because of cost and time overrun. Under a directive from the RBI last year, lead lender SBI took the company to the NCLT under the bankruptcy code.

However, ECL, which operates a successful DI pipe plant at Khardah near Calcutta, is expecting Rs 213.47 crore as "receivable" despite losing control of ESL.

"Pending the final order of the NCLAT, advances & trade receivables amounting to Rs 213.47 crore receivable from ESL along with mortgage of certain land & building of the company situated at Elavur, Tamil Nadu, in favour of one of the lenders of ESL, has been carried forward at their carrying value. Necessary adjustment shall be carried out upon assessment of recoverability of the same in terms of approved resolution plan," the company said.