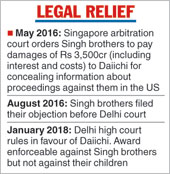

New Delhi: The Delhi high court on Wednesday upheld an international arbitral award of Rs 3,500 crore passed in favour of Japanese pharma major Daiichi Sankyo, which has alleged that the former promoters of Ranbaxy Laboratories Ltd had concealed information about proceedings against them in the US.

A tribunal in Singapore had passed the award in favour of Daiichi, holding the former Ranbaxy promoters and brothers, Malvinder Singh and Shivinder Singh, had concealed information that Ranbaxy was facing probe by the US Food and Drug Administration and the US Department of Justice while selling its shares.

The Singh brothers had sold their shares in Ranbaxy to Daiichi in 2008 for Rs 9,576.1 crore. Sun Pharmaceuticals Ltd later acquired the company from Daiichi.

Justice Jayant Nath, however, said the award is not enforceable against five minors, who were also shareholders in Ranbaxy, saying they cannot be held guilty of having perpetuated a fraud.

"The respondents (Singh brothers) received Rs 9,576.1 crore by selling their shares. Damages have been assessed at Rs 2,562 crore plus interest and costs. The plea of the respondents cannot be accepted. It is not possible to come to a conclusion that the computation done by the arbitral tribunal is in complete breach of statutory provisions or is contrary to fundamental policy of Indian law inasmuch as the said computation suffers from patent illegality, going to the root of the matter," the court said.

The spokesperson of RHC Holding Pvt Ltd, which is owned by the Singh brothers, said, "Today's judgment by the Delhi high court has given partial success to some of the sellers of shares of erstwhile Ranbaxy (respondents). However, we are disappointed with the ruling against the rest of the sellers. After studying the order in detail, the respondents will decide on further course of action."

Daiichi had approached the Delhi high court in 2016 to seek the enforcement of a Rs 2,562-crore Singapore arbitral award passed in April 2016. PTI

, along with an additional claim of interest and lawyers' fees incurred in connection with the proceedings. The tribunal's award had come after the Japanese company invoked arbitration clause against Singhs alleging that they concealed important information while selling Ranbaxy in 2008. Daiichi had entered into a settlement agreement with the US Department of Justice, agreeing to pay USD 500 million penalty to resolve potential, civil and criminal liability. The company had then sold its stake in Ranbaxy to Sun Pharmaceuticals for Rs 22,679 crore in 2015. Singh brothers' counsel had argued the award granted consequential damages which were beyond the jurisdiction of the arbitral tribunal and the award cannot be enforced under the provision of the Arbitration Act. They had also raised the aspects of violation of fundamental public policy of India and time barred under the limitation act. They had alleged that Daiichi was fully aware of all facts and still chose to retain the Ranbaxy shares, instead of terminating the agreement and returning them.