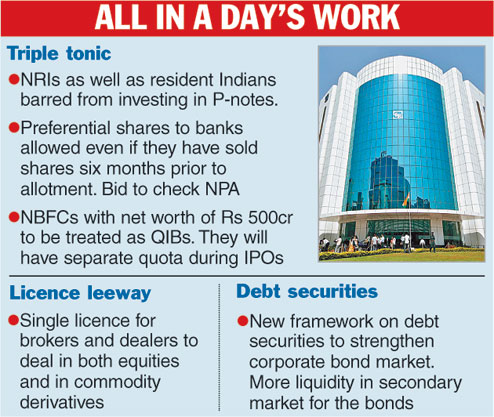

Mumbai, April 26: The Securities and Exchange Board of India today threw the gauntlet at rogue investors by banning resident and non-resident Indians from subscribing to offshore derivative instruments (ODIs), commonly known as participatory notes (P-notes).

The ban will effectively stop the round-tripping of funds through P-notes that have raised regulatory concerns as they tend to mask the the identity of investors.

Sebi chairman Ajay Tyagi said the existing provisions in the form of the regulator's FAQs did bar the NRIs and resident investors from using P-notes, but the provisions approved today would give Sebi a greater legal backing.

The regulator has, therefore, approved the introduction of a new provision in the FPI (foreign portfolio investment) regulations whereby NRIs or resident Indians will be barred from investing in the Indian capital market through ODIs.

"An express provision shall be inserted in the regulations to prevent resident Indians/NRIs or the entities which are beneficially owned by resident Indians/NRIs from subscribing to ODIs," the regulator said.

The Sebi board gave some good news to banks burdened with huge bad assets. It decided to allow issuers to make preferential allotments to banks and financial institutions even if the lenders had sold such shares six months prior to the allotment.

Banks and financial institutions, therefore, have been exempted from the six-month lock-in period on the sale of shares received in the form of preferential allotments. At present, only mutual funds and insurance companies enjoy this exemption.

This move was taken to help banks to skirt around regulations that have impeded their efforts to recover dues from defaulters at a time the non-performing assets have soared to Rs 14 lakh crore.

In yet another significant decision, Sebi allowed non-banking finance companies (NBFCs) registered with the Reserve Bank of India (RBI) and having a net worth of over Rs 500 crore to be included in the category of qualified institutional buyers (QIBs).

NBFCs will now become eligible along with banks and insurance companies to participate in initial public offerings with a specific quota reserved for them.

This is expected to further strengthen the IPO market and channelise more investments.

Separately, the market regulator decided to grant a unified licence to brokers and clearing members to operate in the commodity derivative as well as in the equity markets.The board approved a proposal for integration of stock brokers in equity and commodity derivative space. ollowing this,

<> A broker or a clearing member in the securities markets will now be allowed to buy, sell or deal in commodity derivatives without setting up a separate entity and vice-versa.