Markets were quick to pick up on the CRR proposal, and both the stock and the bond markets reported sharp gains, with additional support coming from the LIC, the largest shareholder in IL&FS, which pledged funds infusion to keep the troubled infrastructure firm afloat. The Sensex went up 347 point to 36652.02, while the 10-year benchmark bond yield eased 1 basis point to 8.12 per cent.

Markets have been in turmoil after problems at IL&FS as well smaller NBFC Dewan Housing Finance came into focus last week. Credit woes along with tighter liquidity and higher interest have created the fear of a contagion in markets.

Finance ministry officials admitted inflation remained an issue in policy-making, since this was a pre-election year.

A Credit Suisse report released earlier this month gave a mixed outlook, with headline inflation easing in recent months owing to good rains but core inflation rising.

“Confluence of these factors could prompt the RBI to raise interest rates once again by 25 basis points or even 50 bps in the October policy meeting. Higher interest rates will have a negative impact on growth expectations as well,” the report said.

A government suggestion for the RBI to cut its cash reserve ratio (CRR) and calm the financial markets did not find favour with bankers and RBI veterans as the increase in liquidity from the CRR cut would end up stoking inflation.

At present, the CRR, or the amount of money a bank has to compulsorily keep with the RBI, stands at 4 per cent of a bank’s total deposit.

A cut in the CRR are among the options the RBI could explore to improve liquidity, a finance ministry official said on Tuesday.

Top bankers, here to meet finance minister Arun Jaitley for the annual performance review of their banks, said it would be better for the RBI to opt for market interventions by buying bonds which could release liquidity into the system, as and when required.

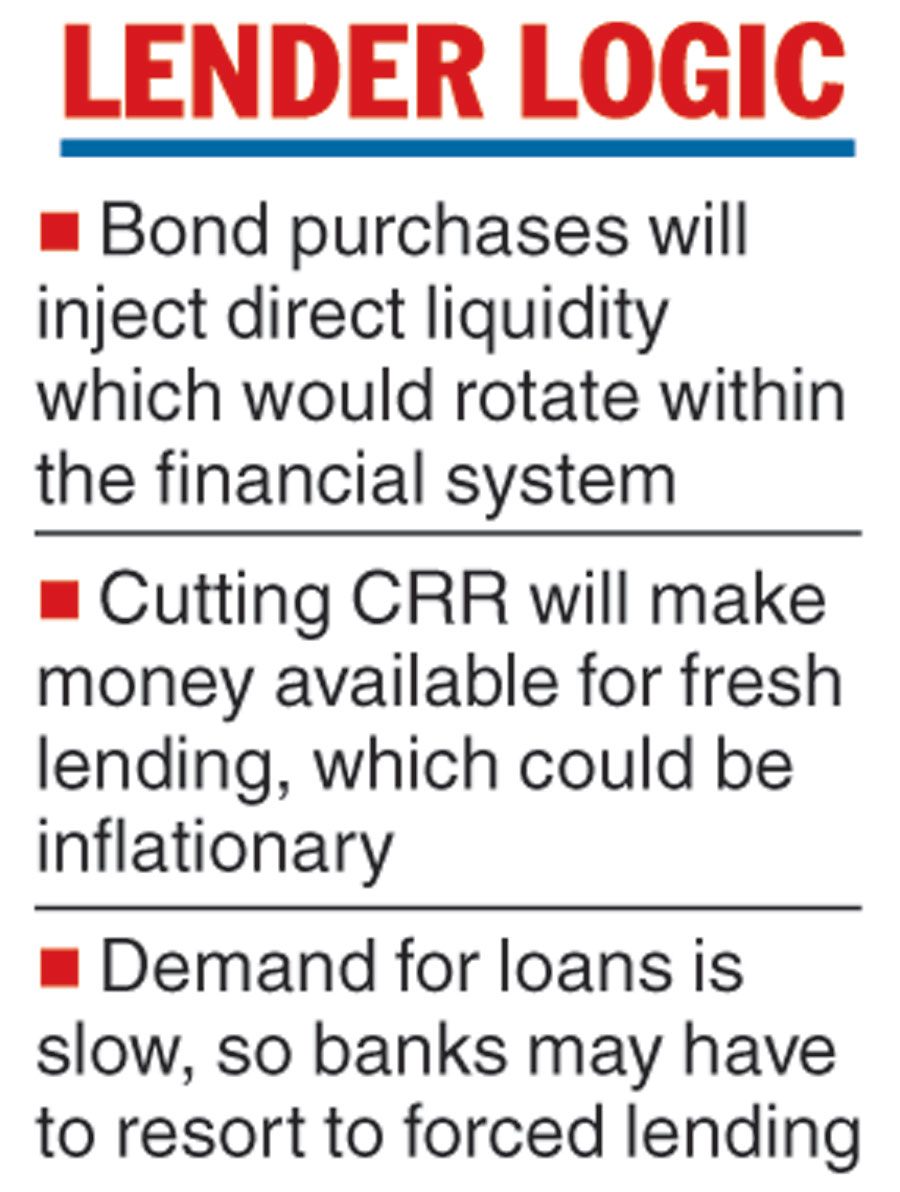

“Bond purchases would inject direct liquidity which would rotate within the financial system. However, cutting the CRR will make money, and a lot of it, available for fresh lending. First, that could be inflationary, second, the demand for loans is slow, so banks may well have to resort to forced lending,” said bankers.

Industrial credit grew near 0.3 per cent in July and food credit grew 0.3 per cent. Overall, non-food credit grew 10.6 per cent, but this was on account of service sector credit rising 23 per cent.

The Telegraph